- The GBPUSD pair rally hit a wall at a key resistance level as the UK prepares for a large bond sale and ahead of the FOMC interest rate decision. what next?

The GBPUSD pair declined by more than 0.60% as the US dollar gained strength ahead of the Fed interest rate decision. The pound also weakened against the euro, Australian dollar, and Swedish krone.

British pound falls ahead of FOMC

The GBPUSD pair declined as the FOMC starts its meeting today. The bank, which will deliver its decision tomorrow, is expected to leave interest rates unchanged between 0.0% and 0.25%. The bank will also likely leave its open-ended quantitative easing program in place.

Still, analysts will be watching for two main things. First, they will watch the bank’s statement about the current recovery especially after the spectacular jobs report on Friday. The numbers showed that the US added more than 2.5 million jobs while the unemployment rate declined.

Analysts were quick to point that the jobs added were not new jobs but furloughed people who were coming back to the labour force. Second, the officials will talk about the likelihood of a V-shaped recovery that most analysts believe will happen.

GBPUSD falls as the government plans debt sale

The GBPUSD pair also fell as the government prepared for another debt sale. This is after Ireland raised $79 billion from the debt market and Spain attracted more than 78 billion euros. According to Bloomberg, the country plans to raise £9 billion in the market, pricing them at 0.5% above comparable bonds. Analysts expect that the orderbooks will be more than £70 billion.

Still, the challenge for the UK and the pound is Brexit. At the conclusion of the fourth round of talks, the leaders said that no progress was made. The ball is now in Johnson’s court as he thinks about whether to request an extension to the transition period.

Download our Q2 Market Global Market Outlook

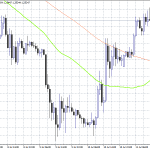

GBPUSD technical outlook

On the daily chart, we see that the GBPUSD pair rally hit brakes at 1.2744, which is slightly above the 61.8% Fibonacci retracement level. The pair is still above the 50-day and 25-day exponential moving averages. Also, it seems to be forming a bearish engulfing pattern, which is a sign that the new downward trend may continue. If it does, traders will be targeting the 50% retracement level at 1.2466.

On the flip side, a move above today’s open of 1.2744 will mean that bulls are still in control and that they will attempt to test the next resistance at 1.2800.