- The GBPCAD is weaker on the day by 0.21% as the market pauses ahead of three speeches by Bank of England members and the Canadian employment data on Friday.

The GBPCAD is weaker on the day by 0.21% as the market pauses ahead of three speeches by Bank of England members and the Canadian employment data on Friday.

Today sees speeches by Monetary Policy Committee members Ben Broadbent and Andy Haldane. The speeches may give some insight into the potential for further U.K. stimulus in light of recent housing data. Tomorrow also sees a speech by the bank’s Governor Andrew Bailey. Markets were on guard for further stimulus and possibly negative interest rates, but the U.K. is seeing a glimmer of hope for a recovery.

This morning saw the release of the Nationwide Housing data, which saw U.K. house prices reach an all-time high in August. Prices were 3.7% higher than last year after the market had expected a jump of 2.0%. The 2.0% increase from July, was the largest monthly increase since 2004 and should reassure the country’s central bankers that the broad economy can recover.

Friday will be the Canadian Employment change for August and traders will be looking to see if the Canadian economy can meet the 275k jobs number after 418.5k jobs were added last month. The market is also expecting the unemployment rate to drop from 10.8% to 10.1% and after some strong U.K. housing data, the release will be key to the future path of the GBPCAD.

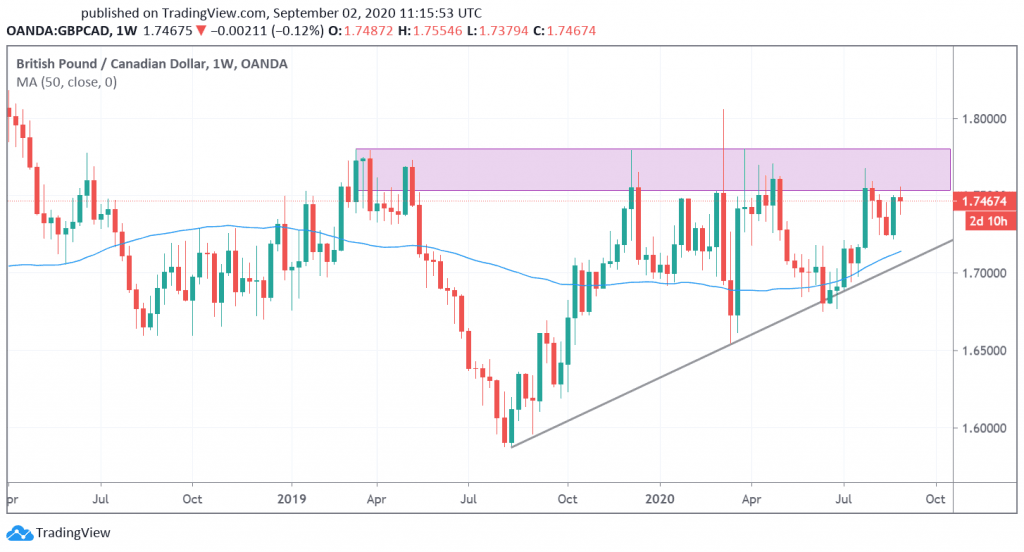

GBPCAD Technical Outlook

The GBPCAD is trading at 1.7467 after strengthening in July. As the chart below highlights, the 1.7500 to 1.7800 levels are thick with resistance levels. The market will need a strong catalyst to breach that level, but if it does then higher prices above 1.8000 would be likely. Downside risk to the long side would be a bearish close around the 1.7200 level.