- Rabobank says the GBP/USD is in danger of falling below 1.2000 ahead of the UK GDP data due for release on 12 August.

The GBP/USD is trading higher this Thursday as the pair continues to benefit from yesterday’s US CPI figures that showed easing inflation. The pair gained 1.12% on Wednesday and is currently up by 0.14%. But despite the gains, which are more of a weaker USD than a stronger Pound, the pair could face some significant headwinds in the weeks ahead.

Analysts at investment bank Rabobank believe that the Pound faces immense downside risks, with the GBP/USD pair possibly dropping below the 1.2000 mark within the next 1-3 months. The pressure comes predominantly from last week’s pessimistic outlook by the Bank of England, with a 15-month recession in view. The BoE also warned of a contraction of the UK economy similar to what occurred in the early 90s.

Also looming large in the background are warnings by the UK government of potential blackouts during the winter, even as energy bills of UK households continue to skyrocket. Rabobank says the Pound has a better chance of holding its own against the Euro, as the Eurozone is also facing a similar energy crisis. Recall that Russia recently halted supplies to Eastern Europe due to failed transit payments.

The pair’s major fundamental trigger would have to be tomorrow’s UK GDP report. Economists project that the UK economy contracted in the month and quarter under review, with GDP m/m projected at -1.2% and prelim GDP q/q expected to have shrunk from 0.8% to -0.2%. If the figures meet or exceed the expectations to the downside, the GBP/USD could be in for a major slide, especially if the price action retreats below 1.20907.

GBP/USD Forecast

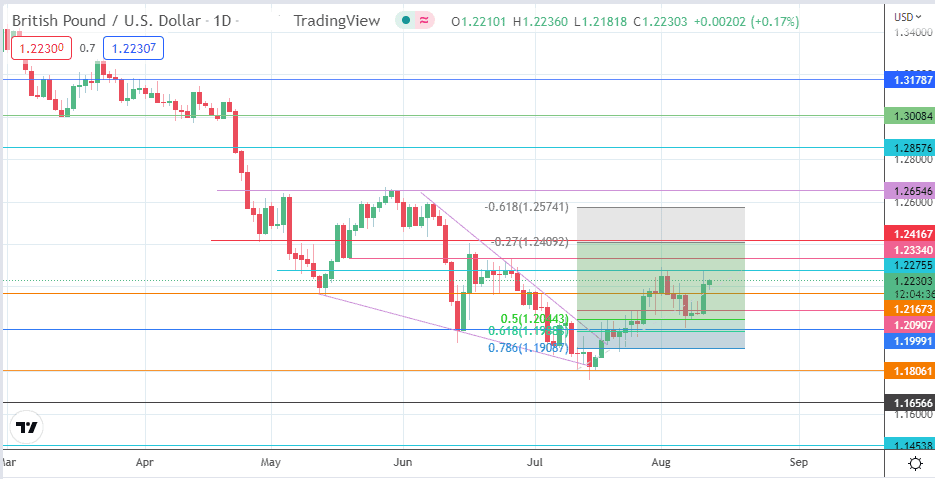

The upside push of 10 August was rejected at the 1.22755 resistance mark (6 May low and 2 August high). The bulls need to force a break of this price mark before the 1.23340 resistance formed by the previous low of 18 May and the prior high of 27 June becomes an attainable upside target. Above this level, 1.24167 (28 April low) and 1.2600 (7 June high and psychological resistance) form other upside targets within the bulls’ reach if there is a price advance.

Otherwise, a failure to breach the 1.22755 resistance could lead to a pullback toward 1.21673 (13 May and 22 June lows). Additional downside targets are 1.20907 (26 July high) and 1.19991 (15 June and 5 August lows). Other southbound price targets are 1.18061 (12 July low) and 1.16566 (25 March 2020 low). This outlook sees the recent rally as a new opportunity for short traders.

GBP/USD: Daily Chart