- The UK's inflation rate rose above 10% in July, while Canada's only rose by 7.6%, providing a basis for GBP/CAD longs on Wednesday.

The GBP/CAD is trading higher on the back of higher consumer prices in the UK after data from the Office of National Statistics showed the annualized Consumer Price Index (CPI) hitting 10.1% for the first time in decades.

Consumer Price Index (CPI) in the United Kingdom rose by 10.1% in July, rising from the previous month’s 9.4% increase and beating the estimate of 9.8%. Core CPI rose 6.2%, beating the 5.9% consensus number and the previous increase of 5.8%.

In contrast, consumer prices in Canada declined. Core CPI monthly fell from 0.7% to 0.1% in Canada, according to data released by Statistics Canada. This translated to an annualized rise of 7.6%, helped by a decline in domestic gas prices.

The contrasting CPI figures put the GBP/CAD on bid, gaining 0.34% on the day. Gains were, however, capped by comments from Bank of Canada Governor Tiff Macklem indicating that the cooling of Canada’s inflation was not necessarily going to stop the bank from raising rates to achieve the 2% inflation mandate of the BoC.

GBPCAD Forecast

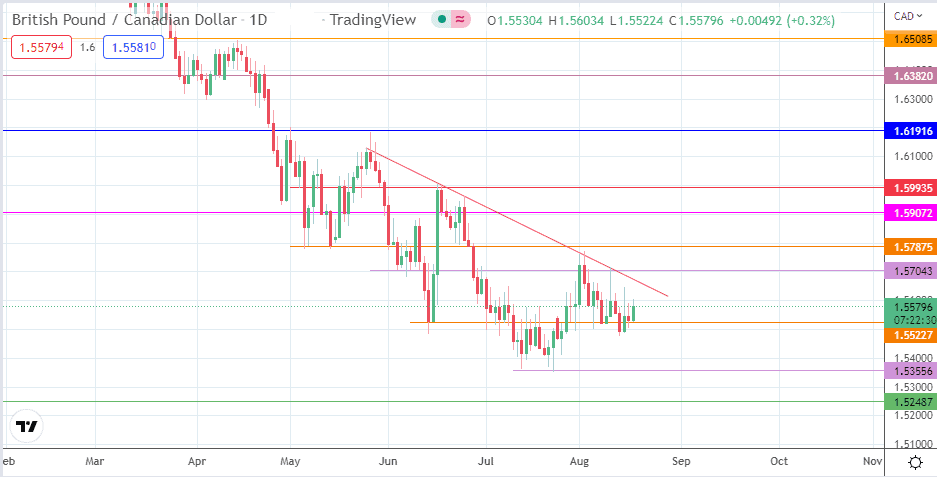

At this stage, a decline is more likely to result from a rejection off the descending trendline, close to the 1.57043 resistance (3/10 August highs). A breakdown of the 1.55227 support resulting from this rejection targets the 13 July/22 July lows at 1.53556. If the decline continues below this pivot, 1.52487 becomes the new target, being the site of multi-year lows of 8 July 2011 and 11 March 2014.

On the other hand, a break of the 1.57043 resistance also takes out the trendline, giving the GBP/CAD the potential to perform a recovery retracement that targets 1.57875 initially before taking on the 1.59072 resistance formed by the 31 May and 17 June prior lows. Above this level, the 1.59935 resistance (4 May low and 16 June 2022 high) and the 1.61916 resistance (2 May high) form additional northbound targets.

GBP/CAD: Daily Chart