- The GBP/AUD pair will look toward the Australian Wage Price Index (q/q) for near-term direction after the RBA's mild;y hawkish minutes.

The GBP/AUD pair gained 0.78% on Monday after weak Chinese data dented the performance of commodity-linked currencies such as the Aussie Dollar. However, the release of the minutes of the last meeting of the Reserve Bank of Australia has reinstated hawkish sentiment around the Aussie Dollar.

What did the RBA’s minutes say to cause the upside retracement in the GBP/AUD to stall? Essentially, the apex bank noted that it expected inflation in Australia to peak later in the year. However, in the wording of the minutes, inflation was not expected to “peak later and higher than previously thought,” even as measures of longer-term inflation expectations had declined. The bank also noted gradual normalization of supply chain conditions as China’s COVID-19 situation was starting to improve, with lesser restrictions, a pick up in exports, and global trade.

The RBA also noted the presence of tighter domestic labour conditions, with an expected increase in wage growth. 60% of the private sector expects wages to rise by more than 3% in the next year. The RBA projects the Wage Price Index (WPI) to rise to 3.75% by 2024, a 12-year high if it materializes. It rounded off the statement by saying it expected to take further steps to normalize monetary conditions in the months ahead, given the projected increase in the wage index and consumer price indices. Still, this action would not be on a pre-set path. In other words, the RBA expects to keep raising rates, but the extent of any tightening (if any) would be data-dependent.

The latest quarterly wage price index data is due for release early Wednesday, 17 August. The consensus is for an increase from 0.7% to 0.8%, in line with the RBA’s expectations of an increasing wage inflationary outlook. If this result comes out at 0.9% or higher, this would be bearish for the GBP/AUD pair.

GBP/AUD Forecast

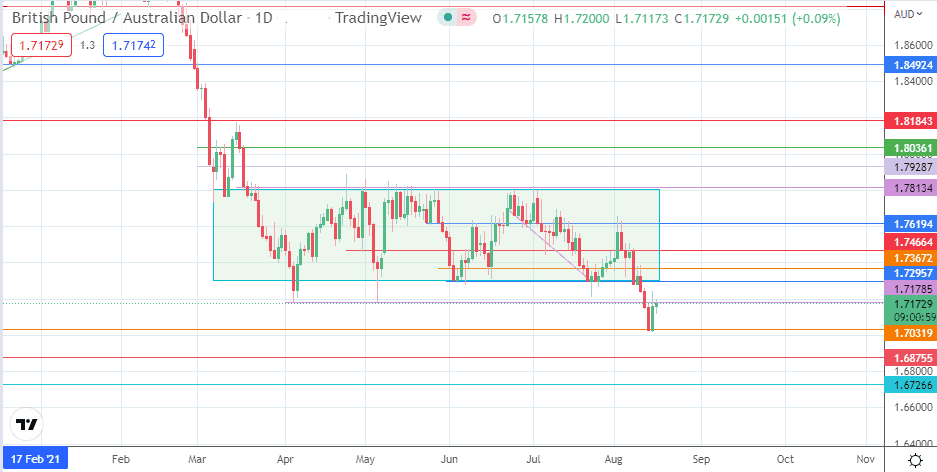

Following a bounce on the 1.70319 support level, the pair has met a wall at the 1.71785 (5 April/5 May 2022 lows) price resistance. This comes after the GBP/AUD pair found support at the 23 June 2017 high at 1.70319 following Friday’s post-NFP decline. A resumption of the decline will have to retest this support mark. A breakdown of this price level brings the 26 September 2016 low at 1.68755 into the picture as the new downside target. Further price deterioration brings the 15 August 2016 low/12 April 2017 high at 1.67266 into the mix as an additional harvest point for the bears.

Conversely, any hopes of recovery will depend on the bulls breaking above 1.71785. If this is done, the rectangle’s degraded lower boundary at 1.72957 becomes the next upside target. Additional targets to the north will come in at 1.73672 (1 June low and 28 July low) and 1.74644 (2 June and 8 August highs) if the advance continues. Only a break of the 1.76194 and 1.78134 (rectangle’s upper border) price barriers will reverse the prevailing downtrend.

GBP/AUD: Daily Chart