- The FTSE 100 index is wavering as traders react to the weak UK inflation data. But data suggests that the index will rise. Rolls Royce share price falls to 2004 lows

The FTSE 100 is little changed today as traders wait for the Federal Reserve interest rate decision. The index is also falling because of the relatively strong pound and the mixed August inflation data. It is trading at £6,116, which is the highest it has been in about three weeks.

Other European indices are relatively higher, with the DAX index, CAC 40, and Stoxx 50 up by more than 0.20%.

A stronger British pound tends to be relatively negative for the FTSE 100 and other UK companies. That is because most of the constituent firms do a lot of business abroad and report their earnings in pound. As a result, a stronger pound tends to have a negative impact on demand for their products. This week, the British pound has been in an upward trend as investors remain optimistic that the UK government will reach a Brexit agreement with the EU. In a report, analysts at Danske Bank said that they are 60% confident that the two sides will reach a deal.

The FTSE 100 is also falling because of the mixed inflation data from the UK. Data from the Office of National Statistics (ONS) showed that the headline inflation dropped by 0.4% in August. That was better than the 0.6% decline that analysts were expecting. On an annualised basis, the consumer inflation rose by 0.2%, the lowest increase since 2015. The decline was mostly because of the Eat Out to Help Out policy by Rishi Sunak. The small increase was attributed to a sharp increase in video game prices.

Most companies in the FTSE 100 are in the red today. Tylor Wimpey, the leading homebuilder, shares are down by more than 2.80%. It is followed by British Airways owner, IAG, whose shares are down by more than 2.17%. Melrose and Rolls Royce share prices are the other leading laggards. Rolls Royce stock has dropped to the lowest level since 2004.

On the other hand, the top risers in the FTSE are Kingfisher, M&G, Fresnillo, and Associated British Food, whose shares are up by more than 2%.

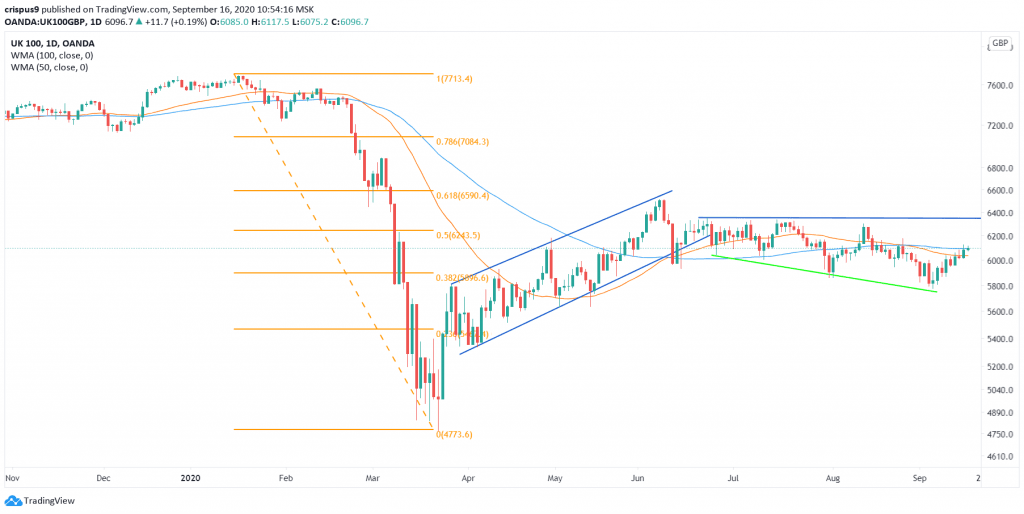

FTSE 100 technical outlook

The FTSE 100 is trading at £6,090, which is slightly below the yesterday’s high of £6,120. On the daily chart, the price is above the important support that is shown in green. The price has also moved above the 50-day and 100-day weighted moving averages. It is also slightly below the 50% Fibonacci retracement level.

This retracement connects the highest and lowest levels this year. Therefore, I suspect that the index will continue rising as bulls aim for the upper resistance level at £6400.

On the flip side, a move below the psychologically-important resistance level of £6,000 will invalidate this trend.