- The FTSE 100 share price index has been in an aggressive downtrend for the past two trading sessions. In today's trading session

The FTSE 100 share price index has been in an aggressive downtrend for the past two trading sessions. The index is already down by 70 points in today’s trading session, and the trend looks highly likely to continue.

Today’s fall also comes amidst reports of inflation and recession fears across the UK. The pound has also slumped in the past few days, which has offered FTSE some protection for dollar companies listed on the index.

FTSE 100 index has also fallen due to the underperformance of some of the listed companies. This includes IAG, the British Airways owner, which has recorded the largest fall in today’s trading session. This is despite the company projecting profitability for the rest of the year as travel demand rebounded.

Fortunately, even with the current FTSE drop, it is unlikely that the Index will sink at the same rate as NASDAQ is doing. This is because, unlike NASDAQ, which is composed of mainly technology companies, FTSE is a very diverse index composed of companies from industries such as banks, insurers and natural resources. These companies are still reporting huge profits and thriving in the current markets. Therefore, it is unlikely to see the FTSE index sinking as we are seeing with other indices, which are currently in freefall.

The companies listed in FTSE also look reasonably priced compared to other markets. Therefore, even with fears of recession and high inflation, there is a slight chance that the FTSE is going to crash as we are experiencing with other types of indices. However, most companies listed in the index also look like they are doing great.

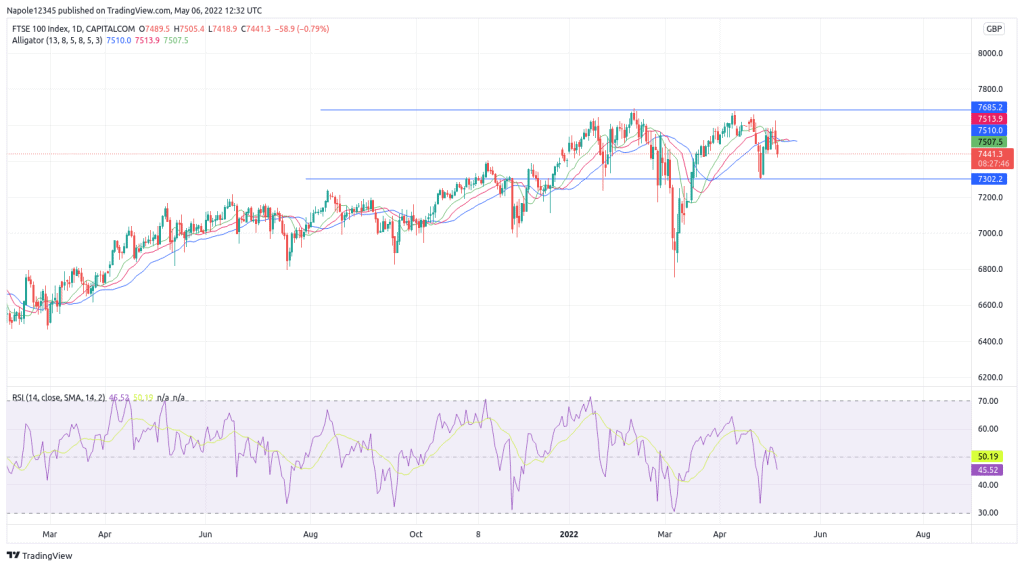

FTSE Price Prediction

In today’s trading session, FTSE is down by 70 points and is likely to continue with the bearish trend throughout the session. However, the index is still in a long-term bullish market, and I expect the prices to recover as early as the first trading session of next week. Currently trading at 7454, it is also highly likely that we will be seeing the index trading above 7500 within the next few trading sessions.

FTSE Daily Chart