- What is the outlook of the FTSE 100 index ahead of the key earnings from Aviva, Vodafone, and Burberry? We explain.

The FTSE 100 index is holding steady even as the UK becomes the centre stage for stagflation in western countries. The footsie rose to £7,506, which was the highest point since May 6th this year. It has risen by more than 4.5% from its lowest point last week. So, will these gains continue ahead of key company earnings and economic data?

Aviva and Vodafone earnings ahead

The ONS will publish some important economic numbers that will provide more sentiment about the UK economy. The agency will release the latest consumer and producer price index (PPI) data on Wednesday. Economists expect these numbers to show that inflation continued rising in April as petrol prices remained at elevated levels. These numbers are important because they will provide more outlook about the next Bank of England (BOE) meeting.

This week, there will be important corporate results that will affect the FTSE 100. Retailers like Home Depot, Walmart, Lowe’s, and Target will publish their results in the US. While these are American companies, they will provide more information on the state of retailers. As such, companies like Tesco and Sainsbury will be in focus.

In the UK, the top FTSE 100 and FTSE 250 companies that will publish their results are Royal Mail, Vodafone, Aviva, Burberry, British Land, and Royal Mail. Conversely, the top companies in the index that will go ex-dividend this week are GSK, Tesco, Unilever, Pershing Square, and Shell.

FTSE 100 forecast

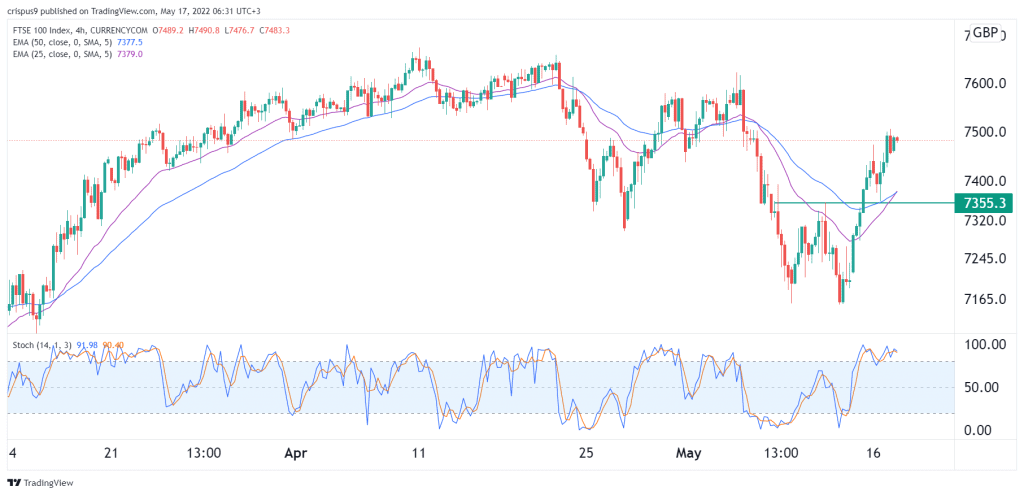

On the 4H chart, we see that the FTSE 100 index has been in a strong bullish trend in the past few days. The rally accelerated when the index rose above the key resistance at £7,355, which was the highest point on May 11th. At the same time, the 25-day and 50-day moving averages have made a bullish crossover while the Stochastic Oscillator has moved above the overbought level.

Therefore, the outlook for the FTSE index is still bullish, with the next reference level being at £7,600. A drop below £7,453 will invalidate the bullish view.