The rupee slipped in early trade today, with USDINR pushing up toward ₹86.63 as dollar demand from corporates stayed steady. Crude oil isn’t easing either, prices remain firm, keeping pressure on importers and dragging sentiment across the board.

But the bigger story came from across the Atlantic. The Fed left rates unchanged overnight for the sixth straight meeting, but Powell wasn’t exactly dovish. If anything, he leaned a touch firmer than markets expected, flagging sticky inflation and leaving the door wide open for a year without any rate cuts at all. That was enough to give the dollar a solid lift and send most EM currencies, including the rupee, back on the defensive.

The pressure on the rupee is being driven almost entirely by outside forces, not a weakness in India’s economy

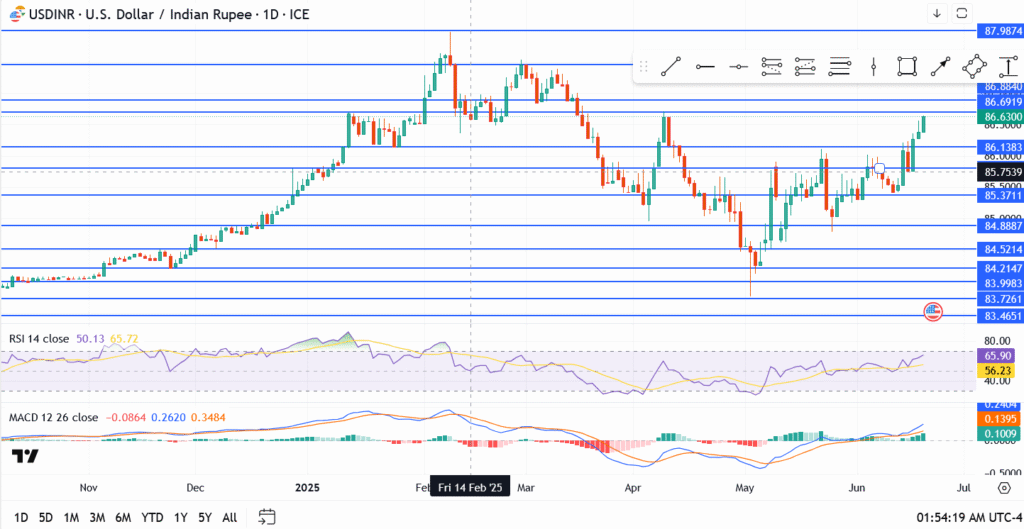

USDINR Technical Chart Breakdown

- Current price: ₹86.63

- Immediate resistance: ₹86.88 -March swing high

- Next breakout level: ₹87.98 – April’s intraday top

- Support to watch: ₹86.13, then ₹85.75

The pair has snapped cleanly above several resistance zones this week, flipping ₹86.13 into support. If the bullish momentum stays intact, a full run toward the ₹88 mark is back on the table.

Conclusion

The rupee’s current weakness is caused by a strong U.S. dollar, Powell’s firm tone, and rising oil costs are stacking the odds against it. With USDINR hovering just below ₹86.88, bulls only need one more push to crack that resistance wide open.

If oil climbs or inflation stays sticky, don’t be surprised to see a test of ₹87.98 in the near term. For now, it’s a clear level: ₹86.88 is the battleground and the buyers are in control.