- JPY outshines majors as hawkish BoJ hopes override Japan's weak Q4 GDP data.

- Slides further below 153.00 and eyes 200-day EMA amid a firmer JPY

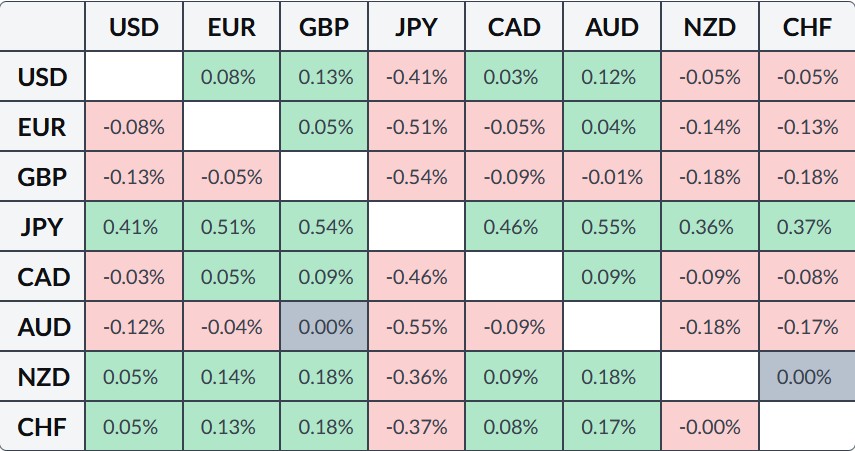

- Yen is outperforming major peers (gaining 0.55% vs AUD) while the Dollar struggles under structural weakness.

The USD/JPY pair has come under renewed selling pressure this Tuesday, surrendering its previous gains to slide below the 153.00 psychological handle. Despite a weak Q4 GDP print on Monday, the Japanese Yen is staging a recovery as traders bet that Prime Minister Sanae Takaichi’s reflationary policies will ultimately force the Bank of Japan (BoJ) to stay on its path toward interest rate normalization.

Hawkish BoJ Expectations Anchor Yen Recovery

The primary driver behind today’s JPY strength is the market’s refusal to abandon the hawkish BoJ narrative.

- Policy Normalization: Investors remain hopeful that fiscal expansion under the Takaichi administration will stimulate growth enough to justify further rate hikes.

- Subdued Greenback: A lack of momentum in the US Dollar (USD) is compounding the pair’s downward move, as the market awaits fresh US catalysts.

- Yen Performance: Today, the Japanese Yen is the strongest performer among major currencies, gaining notably against the Australian Dollar (0.55%) and the Euro (0.51%).

USD/JPY Technical Outlook: Testing the 200-Day EMA Floor

From a technical perspective, the pair is at a critical crossroads as it tests long-term moving averages.

- Immediate Support ($152.50): Spot prices are currently hovering just above the 200-day EMA near 152.50. A break below this level would signal a major shift in the medium-term trend.

- The Fibonacci Floor: Measured from the 140.03 low, the 38.2% Fibonacci retracement level at 152.04 acts as the final “line in the sand” for bulls.

- Bearish Indicators: The MACD remains pinned in negative territory, and the Daily RSI has dipped to 38, suggesting that bearish momentum is currently in control.

Japanese Yen Price Today

The table below shows the percentage change of JPY against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the Australian Dollar, the percentage change displayed in the box will represent JPY (base)/AUD (quote).

USD/JPY Outlook: Can the 200-Day EMA Hold as Bears Press Key Support?

The USD/JPY pair enters the Tuesday European session in a precarious position, with its immediate fate tied to the 152.50 support zone. While the long-term structural trend has favored the Dollar, the resurgence of hawkish BoJ expectations has created a formidable ceiling near 154.00.

For a sustainable rebound, bulls must reclaim the 153.50 level to neutralize the current bearish impulse. Conversely, a daily close below the 38.2% Fibonacci level at 152.04 would likely open the floodgates for a deeper correction toward the 150.00 psychological floor.

The Yen is gaining due to renewed expectations that the Bank of Japan will continue normalizing monetary policy despite recent weak GDP data.

The USD/JPY pair is most active during the Tokyo-London overlap (12:00 PM – 1:00 PM GMT) and the London-New York overlap (1:00 PM – 4:00 PM GMT). Because the Yen is the primary Asian currency and the Dollar dominates Western markets, liquidity peaks when these major financial hubs trade simultaneously, making Tuesday, Wednesday, and Thursday the high-volume days of the week.

Yes, the Yen continues to function as a classic safe-haven currency. During periods of geopolitical tension or global market instability, investors typically rotate out of riskier assets and into the Yen. This safe-haven demand is currently providing an extra “cushion” for the JPY, helping it outperform other major peers like the Australian Dollar and the Euro during the Tuesday session.