- Explore the USD/INR outlook and discover how US tariffs impact India's corporate earnings and investor confidence in the evolving global market.

India’s Q2 Gross domestic product (GDP) grew faster than expected in April-June quarter, reaching 7.8%. However, nominal growth fell to 8.8% from 10.8% in the previous three months, indicating a decline in inflation.

On the other hand, India is facing the challenges of weaking pricing power and U.S. tariffs. These challenges weigh on the USD/INR currency pair, corporate earning, and driving foreign investors away.

In this article, we will explore how the economic data, such as GDP influences the equity market and foreign investment in India, along with the technical outlook for the USD/INR currency pair.

How US Tariffs Impacting India’s Corporate Earnings and Investor Confidence?

According to Mumbai-headquartered ICICI Bank Global Market Research, the growth of the top 3000 listed Indian companies fallen to a seven quarter low of 3.4% on-rear, declining from 5.1% in the previous quarter and 6.8% year-on-year.

Due to weaker nominal GDP growth, weaker credit growth and U.S. Tariffs will continue to keep foreign investors away. Once the U.S. President Donald Trump imposed tariffs on India as much as 50%, Foreign investors have sold $15 billion in Indian equities so far, with $4 billion in outflows in August.

The worst-case scenario is that nominal GDP is expected to fall to 8.5%-9%, the lowest in two decades since the COVID-19 pandemic. If this happens, it could keep corporate earnings and equity markets under pressure.

So far this year, India’s benchmark Nifty 50 index gained around 4%, ranking as the worst performer among MSCI Asia countries, after Thailand and Indonesia.

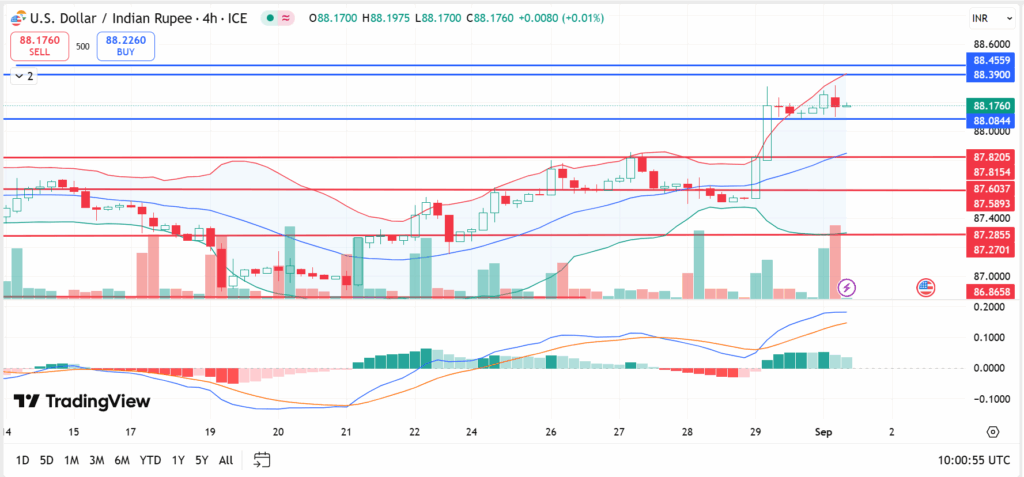

Amid these discouraging signals for the India’s markets, the 1-month-non-deliverable indicates the rupee may open little changed from Friday’s 88.1950, when it touched a record low of 88.3057. With that in mind, let’s shift our focus to the technical outlook for the USD/INR currency pair.

The Technical Outlook for the USD/INR Currency Pair:

The USD/INR opened today at around 88.1610, and and remains near that level, trading at approximately 88.1450 at the time of writing, unchanged from Friday’s range. it’s currently trading under pressure of the resistance level at 88.3432.

However, the USD/INR near-term trend remains bullish, as long as it holds above the support levels near 87.8205 and 87.60. the Relative strength Index (RSI) is above 60.00, signaling that a bullish momentum has come into effect.

Additionally, the MACD histogram on the 4-hour time frame indicates a bullish momentum. On the bullish side, the USD/INR is targeting 88.39. A close above this level could pave the way to all time high 88.45,and sustain consolidation above 88.45 would be needed to reach higher levels towards 89.00.

on the flip side, a break below the support level of 88.0844 could pave the way toward lower levels at 87.82, 87.60 and then 87.15 the low of August 22. Check Top Forex Pairs to Trade in the Asian Session and the last week technical outlook

Key Economic Indicators to Watch:

- Wednesday, Sept 3: India Composite PMI (Aug)

A high reading boosts investor’s confidence and signals stronger growth and potential currency strength.

- Friday, Sept 5: Bank Loan Growth (RBI Data)

Loan growth reflects credit flow to businesses and consumers. A slowdown, as seen earlier with growth under 10%, can pressure bank earnings, consumer spending, and dampen economic momentum.

- Friday, Sept 12: Consumer Price Index (CPI) YOY (Aug)

CPI measures inflation. A risen can push the RBI toward tighter policy, while drop may support rate cuts.

1- Crude Oil Prices: India imports most of its oil, so higher prices weaken the Rupee.

2-US Dollar Value: Most trade is in USD, a stronger Dollar pressures the Rupee.

3-Foreign Investment: Inflows strengthen, outflows weaken the Rupee.

4-RBI Intervention: The central bank can buy/sell currency to stabilize rates.

5-Interest Rates: Higher rates attract capital inflows; lower rates can cause outflows.

Higher inflation means the rupee loses value, especially if it’s higher than in other countries. it raises exports costs and leads to more Rupees being sold to but imports, which weakens the currency. However, high inflation can also push the RBI to raise interest rates, attracting foreign investors and supporting the Rupee. Low inflation usually has the opposite effect.