- USD/INR starts the week on a positive note. Discover the key factors influencing the pair and its technical outlook.

Following a flat opening for the USD/INR at the start of the week, it rose to near $87.60, while the US Dollar index faced sell pressure, reaching $97.50. All of these reactions are due to the dovish tone from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, signaling that monetary policy would be adjusted in accordance with economic conditions and would likely involve rate cuts soon.

On Friday, Powell’s remarks at Jackson Hole indicated that in September, the US interest rates would likely be cut, which sent the dollar index and U.S. Treasury yield lower. The dollar index dropped 1% on Friday.

While Powell said “the baseline outlook and shifting balance of risks may warrant adjusting our policy stance,” the 2-year treasury yield declined more than 10 points.

In response to the U.S. yield fall, the dollar/rupee forward premiums surged, with the 1-year implied rising 6 basis points to 2.19%, marking its highest in three months.

All Eyes on US Tariffs:

The rupee’s upside is likely capped by the U.S.tariffs. Starting Wednesday, U.S. tariffs on indian goods will rise to as high as 50%, up from 25% already in place, among the steepest imposed on any major trade partner. Washington says the latest hike is a response to New Delhi’s continued purchase of russian crude.

The Technical Outlook for the UDS/INR:

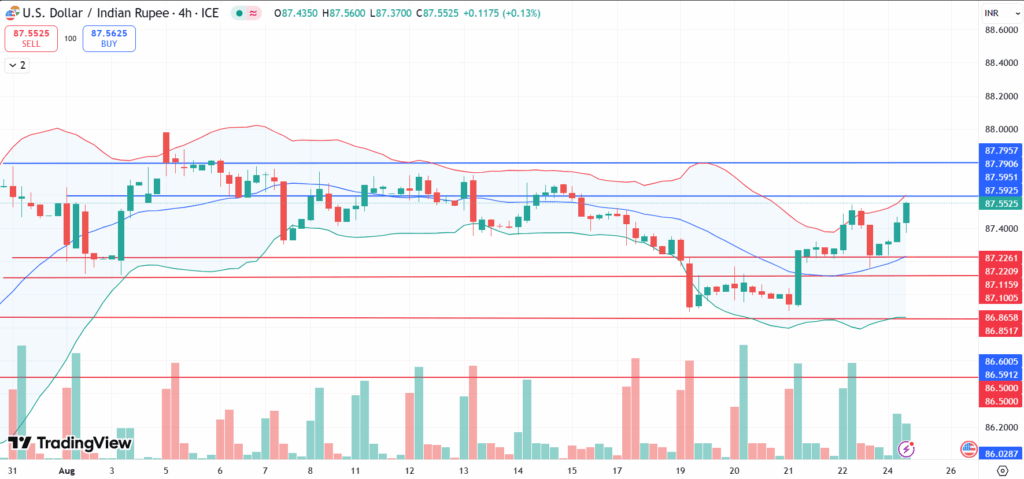

From the technical perspective, by the start of the trading session, the USD/INR pair rises to near $87.60 on Monday, but is still in the same range as Friday’s trading levels.

According to the Bolingar bands level, the pair is under pressure from the resistance level of $87.80. A clear 4-hour close above $87.60 is needed for the USD/INR to confirm its bullish trend towards the $ 87.80 resistance. Breaking above this level would likely support the pair in reaching the August 5 high of $88.25, a critical level for the USD/INR.

On the flip side, the key support for the USD/INR is the July low at $ 86.55. If the pair loses its strength with a clear 4-hour break below the support level at $ 87.22, this would pull the USD/INR towards lower levels, reaching $86.86 and then $ 86.50.

Other Factors Influencing the Rupee (USD/INR):

- Foreign fund outflow: the continuing outflow of foreign funds from the indian stock market has been a major drag on the indian rupee.

- FII activity in August: Foreign Institutional Investors (FIIs) have sold stakes worth 25,751.02 crores in rupees from indian equity markets this month.

- Good Sentiment on Monday: indian markets opened higher on positive sentiment after the Fed’s dovish interest rate outlook. Nifty 50, Up 0.4% aiming to revisit the psychological level of 25,000.

- The key upcoming trigger is the Q2 Gross Domestic Product (GDP) data, which will be released on Friday.

- For Q1, the Indian economy grew at an annual rate of 7.4%. Keep an eye on the economic calendar to anticipate where the USD/INR might head next.