- AUD/USD hit an intraday high of 0.7090 this Thursday, marking its strongest performance since early 2023.

- 3.8% CPI Shocker: Australia’s headline inflation accelerated to 3.8% in December, far exceeding the RBA's target and forcing all "Big Four" banks to forecast a rate hike next week.

- China Policy Boost: Reports that Beijing may scrap the "Three Red Lines" property debt framework have triggered a massive rally in proxy currencies like the AUD.

- Bullock Vindicated: Governor Michele Bullock’s previous "no rate cuts" warnings have been validated by a resilient labor market and rising export prices (up 3.2%).

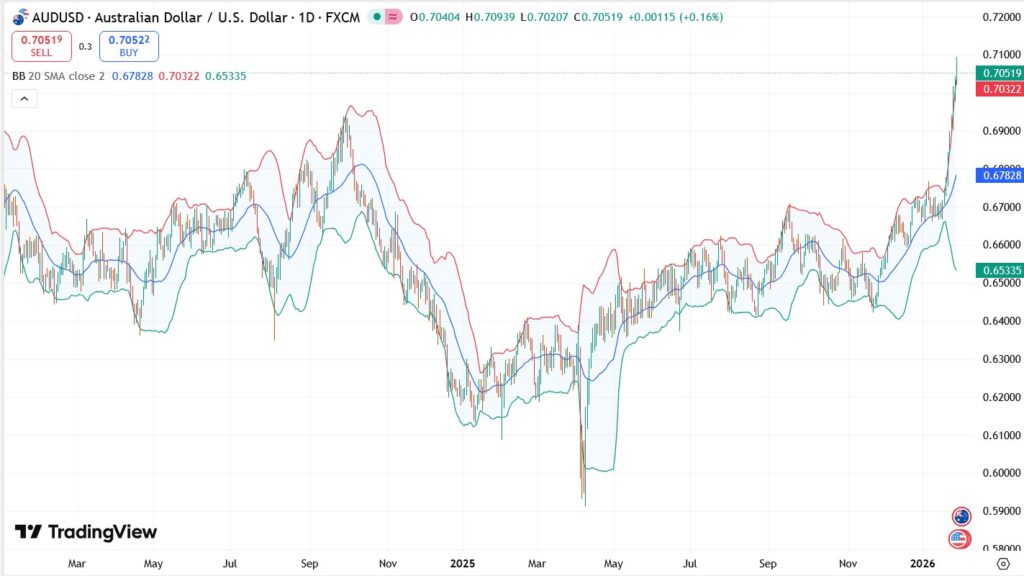

The Australian Dollar (AUD) is the strongest-performing G10 currency this Thursday, reaching levels not seen since a brief spike in early 2023. The pair successfully shattered the 0.7000 resistance ceiling after a “perfect storm” of hawkish domestic inflation and aggressive policy easing from China. This move represents a dramatic shift from the 0.62–0.66 range the Aussie has occupied for much of the past year.

Will the RBA Hike to 3.85%? Big Four Banks Pivot After 3.8% Inflation Shocker

The primary driver of the Aussie’s dominance is the December CPI report, which showed headline inflation jumping to 3.8% year-on-year, up from 3.4% previously. This “uncomfortably persistent” inflation has completely reshaped the Australian interest rate outlook for 2026.

In a stunning reversal, all four major Australian banks (CBA, Westpac, NAB, and ANZ) have now revised their forecasts to predict a 25-basis-point hike to 3.85% at next Tuesday’s meeting. NAB has even signaled that a second hike to 4.10% could be necessary by May if the labor market, which currently boasts an unemployment rate of just 4.1%, continues to run hot.

Bullock’s “No Rate Cuts” Warning Vindicated by Export Price Rebound

RBA Governor Michele Bullock’s strident warnings in late 2025 that “rate cuts are not on the horizon for the foreseeable future” have been proven correct. Her “higher for longer” stance was initially met with skepticism by a market expecting relief, but the latest data has fully vindicated the RBA’s caution.

The Australian economy continues to “run hot,” with unemployment falling to 4.1% in December. Further supporting the AUD is today’s Terms of Trade data, which showed export prices rebounded by +3.2% q/q, driven by strong demand for Australian base and precious metals.

China Property Shift: How Beijing’s “Three Red Lines” Easing Fuels the AUD

As a key proxy for Chinese growth, the Aussie received an additional catalyst today from reports that Beijing is scrapping the “Three Red Lines” policy. This regulatory framework, which has constrained developer leverage since 2020, is reportedly no longer required for monthly reporting, signaling a tangible easing of the property crisis.

The news sent the CSI 300 Real Estate Index up 5% to its highest level in two months. For Australia, this shift implies a more stable outlook for iron ore and bulk export demand, which has historically provided a solid fundamental floor for the AUD/USD during times of global volatility.

AUD/USD Technical Analysis: Bulls Eye the 0.7137 Resistance

From a technical perspective, the AUD/USD has transitioned from a steady climb into a sharp bullish impulse:

- Mult-Year Highs: Today’s breach of 0.7090 represents the highest level for the pair since Valentine’s Day 2023.

- Momentum Indicators: While the RSI is testing overbought levels, the broad-based US Dollar sell-off (down 0.30% today) is providing the necessary momentum to sustain the move.

- Critical Support: The previous resistance at 0.7000 has now flipped into a major psychological support floor.

Key Levels to Watch:

- Support: 0.7000 (Psychological), followed by 0.6943.

- Resistance: 0.7090 (Intraday High), followed by 0.7137.

Conclusion: Will the AUD/USD Multi-Week Rally Hold Above 0.70?

As we approach the end of January, the AUD/USD forecast remains bullish as Australia becomes the “last hawk standing” among major central banks. The convergence of a 3.8% inflation shock, a unanimous hike prediction from the “Big Four” banks, and China’s property pivot has created a powerful structural breakout. While a short-term pullback to retest 0.7000 is possible, the widening interest rate gap between the RBA and a cautious Fed suggests that the Aussie’s run toward 0.7137 is far from over.

AUDUSD FAQs

Australia’s headline inflation re-accelerated to 3.8% in December, while the “trimmed mean” (the RBA’s preferred core measure) remains uncomfortably high at 3.4%. This data effectively “voted” for a hike, leading CBA, Westpac, NAB, and ANZ to predict a move to 3.85% next week.

The “Three Red Lines” were strict debt rules that crippled Chinese property developers. By reportedly scrapping these rules, Beijing is signaling a major support package for construction. This boosts demand for Australian iron ore, which in turn strengthens the AUD as a “China proxy” currency.

While the RBA prefers a “wait-and-see” approach, Bullock has consistently warned that rate cuts are not on the table for 2026. With a tight labor market (4.1% unemployment) and rising energy costs, analysts believe the RBA will remain the “last hawk standing” among global central banks.