Forex traders await today the ECB Economic Bulletin, the ECB M3 Money Supply y/y and the ECB Private Sector Loans y/y all are due at 8:00GMT. In the American forex calendar we have the GDP (q/q), GDP Price Index (q/q), PCE Price Index (q/q), Goods Trade Balance and Initial Jobless Claims will be released at 12:30GMT. The Pending Home Sales data (m/m) expected at 14:00 and the Kansas City Fed Manufacturing Composite Index will be released at 15:00.

In our central bank calendar we have the speeches from FOMC Member Kaplan and ECB President Draghi at 13:30. BoE Governor Carney and BoE Deputy Governor Financial Stability Cunliffe will speak at 13:45GMT

The FOMC Member Bullard will speak at 14:00 while the ECB Supervisory Board Chair Enria speaks at 13:15. Fed Vice Chairman Clarida will hit the wires at 13:45GMT and finally FOMC Member Kashkari will deliver a speech at 18:00

The Bank of Mexico will announce it’s Interest Rate Decision at 18:00GMT

The Japan August machine tools orders y/y came in at -37% while the previous reading was -37.1%.

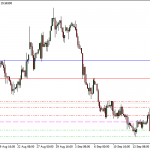

Asian indices are trading mixed today, Nikkei is 0.02% lower at 22,014, the Hang Seng is 0.15% higher at 25,987. EURUSD trades 0.09% higher at 1.0952; the USDJPY is 0.12% lower at 107.63 while the AUDUSD is 0.03% higher at 0.6752.

The central bank of China set the Yuan rate (USDCNY) at 7.0947 versus yesterday fix at 7.0724.