The EURUSD pair is taking a breather today as traders start to refocus on the upcoming Federal Reserve meeting. The pair is trading at 1.1845, which is slightly above the Friday’s low of 1.1817. The pair is in its fourth straight day in the green.

The Federal Reserve is the main focus of the EURUSD and all currency pairs with the US dollar. The bank will start its monthly meeting tomorrow and deliver its rate decision on Wednesday. Going by the bank’s own statements, analysts expect that it will leave interest rate unchanged. The bank is also expected to continue with its open-ended quantitative easing and avoid talks of negative interest rates and yield curve control.

We will be watching closely at the bank’s predictions for the future. Analysts at ING expect the US economy will drop by 4.5% this year followed by a rebound of 4.0% in the coming year. It expects that the unemployment rate will end the year at about 9.3% while the core PCE inflation will be 0.8%.

Meanwhile, after last week’s ECB interest rate decision, there will be not much economic releases from the European Union this week. The Eurostat will release the bloc’s inflation data on Wednesday. But this data will likely not be a market mover because investors already expect the data to show that consumer prices are still below the ECB’s target of 2.0%.

EURUSD technical outlook

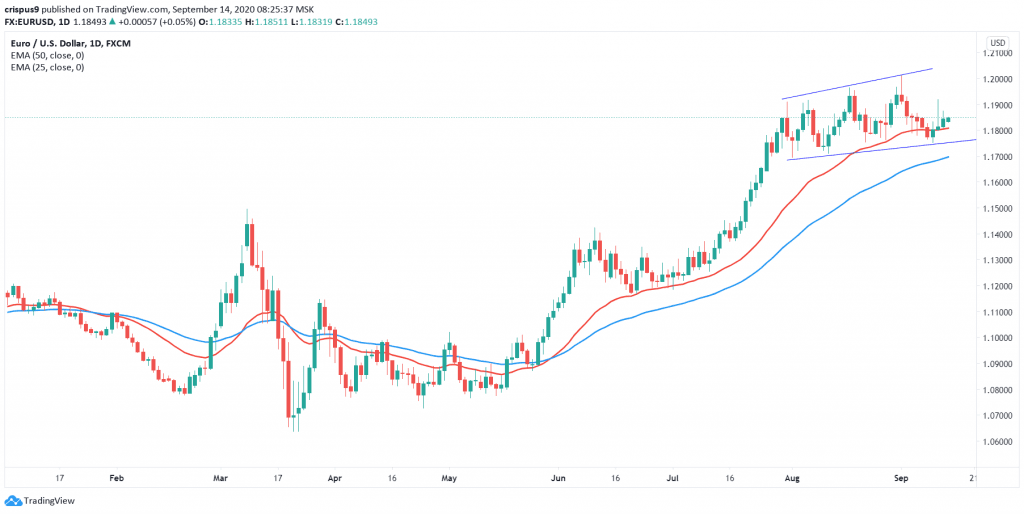

The EURUSD pair is trading at 1.1845. On the daily chart, it is in its third straight day in the green. It is also above the lower line of the ascending channel that is shown in blue. The price is also slightly above the 50-day and 100-day moving averages. Therefore, after the relatively hawkish ECB decision last week, In suspect that the pair is likely to continue rising as bulls aim for the upper side of the ascending channel at 1.2000. But before that, they will need to move above the next hurdle at 1.1900.

On the flip side, a move below last week’s low of 1.1755 will invalidate this trend. This price is along the lower line of the channel and a move below it will send a signal that there are still bears in the market.

Do you want to be an excellent trader? Register for our free forex trading course and one-on-one coaching by traders and analysts with decades of experience in the industry.

Don’t miss a beat! Follow us on Telegram and Twitter.

EURUSD daily chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.