- The EURUSD is trying to turn higher this morning ahead of the important German ZEW Index, due at 10:00 BST. Read our update to find out more.

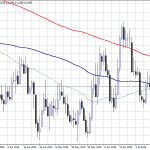

The EURUSD is trying to turn higher this morning ahead of the important German ZEW Index, due at 10:00 BST. However, the trend remains short-term bearish below the August 23 high of 1.1163, and yesterday the price turned lower from the 1.1110 level. If the price revisits yesterday’s morning’s price of about 1.1071, I suspect traders will use this as an opportunity to short-sell the pair once again. I think that as long as the price trades below the August 23 high the EURUSD might revisit its September low of 1.0925. The next support level beyond the September low is the May 2017 low at 1.0836.

However, if bullish traders manage to lift the price over the August 23 high of 1.1163, then traders might seek out the next major high, the August high at 1.1251.

A potential driver of Euro/Dollar price action in today’s morning session is the German ZEW index. The index has a high correlation to German GDP growth, the Euro area’s biggest economy, and economists project that the “economic sentiment” index could turn less negative, from -44.1 in August to -37 in September. A less negative outcome than -37 could boost the Euro by 20 pips, while a lower number than expected might weaken the Euro by the same amount.

For more on the markets, join InvestingCube’s free morning webinar at 9:30 AM London time. In the webinar we cover the EURUSD, major stock indices, Gold prices and Crude oil.