- EURUSD is little changed despite large changes in ECB and Fed monetary policy, and the price might need to trade to 1.12 before the price turns lower.

As the final trading day of the week is about to end, the EURUSD remains mostly unchanged as traders are reluctant to add to their exposure despite the ECB introducing QE last week, and the Federal reserve proved to be less dovish than anticipated by market traders.

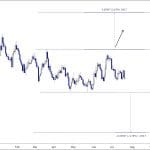

Technically, the EURUSD trend is bearish, but it is not trading at an interesting technical level, as the price is in the middle of the last few months downtrend.

Instead, the price would need to near the blue upper trendline currently at 1.1190 or the lower blue trend line at 1.09 to potentially offer a good trade setup for long-term traders.

Since January 2019, the two blue trend lines along with the two green trendlines have done a good job explaining the price action in EURUSD, and they suggest that the outlook for the EURUSD is lower in the months ahead, and potentially ending the year between 1.0800 and 1.1050. Only if the price manages to breakout above the upper greenline, currently at 1.1310 would that indicate that the trend could have changed.

My take on the EURUSD is that it will continue to trade lower. The Federal Reserve will cut rates, but they do it reluctantly, while the ECB has tried to move ahead of the curve by introducing Quantitative easing. Most professionals I speak with, think 20 billion in QE is not enough, and that the ECB will need to ramp that up in the months ahead, this should be Euro bearish.

On the other side of the Atlantic, the Federal Reserve might need to pick up the pace on rate cutting, but the US economy has so far proved resilient to the US-China trade wars. This might change, as the US ISM declined below 50, and most leading indicators suggest lower US economic growth in the months ahead. However, even if the Fed would cut rates, the US is one of the few places in the world where the yields remain positive with the ten-year government bond yield being at 1.77%, vs. -0.51% in Germany and -0.23% in Japan. The UK offers a positive yield at 0.63% but Brexit related volatility keeps investors at bay.