- EURJPY under pressure ahead of the ECB meeting as the central bank is expected to deliver a dovish statement. Euro's strength will not go unnoticed.

EURJPY trades in a tight range for the entire summer. More or less, it followed on the EURUSD footsteps, a pair that kept trying at 1.20 and failed multiple times during the summer. The months-long consolidation led to the EURJPY forming two possible reversal patterns – a head and shoulders and a double top formation.

Today’s ECB Meeting to Trigger Higher Volatility in the Euro Pairs

The European Central Bank (ECB) is setting its interest rates today and reveals the monetary policy for the period ahead. A much-awaited event, it created tight ranges on the Euro pairs for quite some time now.

The ECB is forced to act today for various reasons, and the bias is that it will deliver a dovish statement. To start with, the core inflation in the Euro area sits far-away from the ECB’s 2% target. More precisely, the last release of 0.4% is closer to the zero level than the ECB’s target. The central bank cannot stay indifferent, watching its price stability mandate endangered.

Moreover, there is a rising risk of de-anchoring of inflation expectations. A central bank’s credibility is tight to its ability to bring inflation to the target. Constant failure to do so threatens the credibility and erodes the Euro.

Last but not least, the stronger Euro puts further pressure on inflation. It rose 4% on a trade-weighted basis since the pandemic reached the Western world. While not much percentage-wise, it is enough to send inflation lower by another 0.2% – to the ECB’s despair.

All in all, the ECB likely delivers a dovish tone, with many market participants expecting a lot from the central bank today.

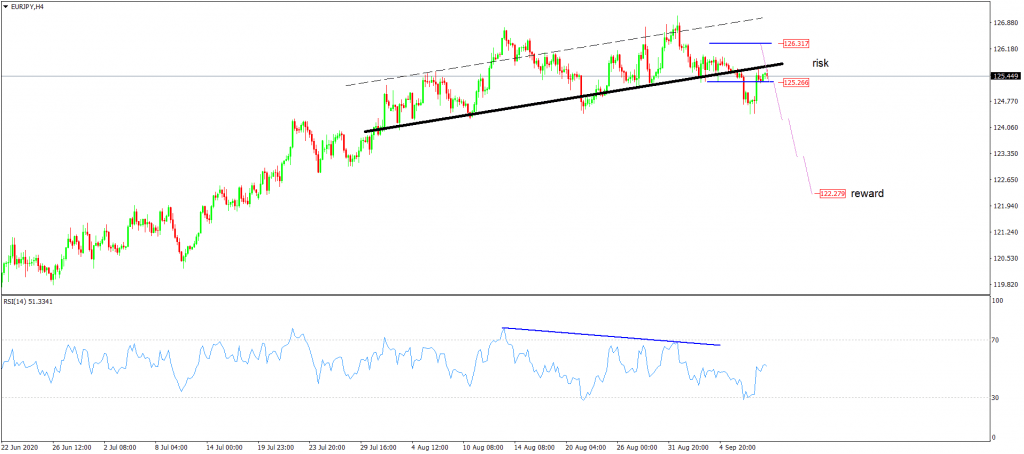

EURJPY Technical Analysis

The EURJPY pair broke the neckline of a head and shoulders pattern and now is retesting it. Bears waiting for the ECB to act may consider going short at the market with a hundred pips stop-loss and a take profit exceeding two-hundred pips. Naturally, the trade should not exceed one percent of the portfolio.

To learn more about technical analysis, consider enrolling in our Forex trading course.