- The volatility of the EURGBP pair declined to a two-month low. This could change as the ECB rate decision nears. The pair could have a significant breakout

The EURGBP pair was little changed today as traders continued to focus on the upcoming decision. The ECB will start its meeting on Wednesday and deliver its rates decision on Thursday.

EURGBP waits for ECB rate decision

The European Central Bank will deliver its much-waited interest rates decision on Thursday. Polls conducted by Bloomberg and Reuters found that most analysts expect the ECB to leave interest rates unchanged at minus 0.5% in this meeting.

The analysts who were polled are divided on whether the bank will offer more support to the economy. A substantial of these analysts expect the bank to commit to do more to cushion the economy. Others see the bank increasing its bond purchases from the current upper limit of €750 billion to more than €1.5 trillion. A smaller number of analysts expect the bank to remove its upper limit.

Analysts expect the bank to offer more financial support to European companies. Just last week, we reported that the bank was starting to buy bonds from risky fallen angels. These are companies that have a low credit rating from credit ratings agencies like Moody’s and Fitch.

The ECB decision will come a day after the Federal Reserve releases its rates decision. It will be three days after the Bank of Japan decided to remove the upper limit of its bond purchases.

Boris Johnson returns

There will be no major economic data from the United Kingdom this week because we received the most important numbers last week. These included the likes of retail sales, inflation, and employment numbers from the country last week. Perhaps, the biggest story is about the return of Boris Johnson.

The prime minister, who was recently in the ICU, is expected to coordinate the country’s battle with the coronavirus. This is as the number of cases has continued to rise. According to Worldometer, the UK has more than 152k infections and more than 20k deaths and the numbers are expected to rise.

Download our Q2 Market Global Market Outlook

EURGBP technical outlook

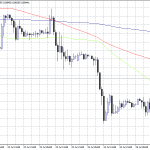

Looking at the four-hour chart of the EURGBP pair, we see that it has been moving sideways since March 31. As a result, the pair has remained within the current channel of between 0.8680 and 0.8888. The price is a few pips below the 50% Fibonacci retracement and 50-day EMA. The low volatility has also been evidenced by the falling average true range.

In the short term, I expect the pair to remain in this current range as traders wait for the ECB decision. Moves below the lower support of 0.8680 will likely see the price continue in the previous trend. Similarly, moves above the resistance of 0.8888 will see the pair start a new bullish trend.

On the flipside, the current low volatility could lead to wild swings ahead of the ECB rates decision.