- UK Prime Minister promises to deliver Oct 31 Brexit deadline "come what may" at Tory Party conference, sending the EURGBP higher on the day.

The EURGBP is trading higher on the UK Prime Minister’s Brexit comments at the Conservative Party conference in Manchester. The British Prime Minister is sticking with the Oct 31 Brexit deadline. According to him, “we are coming out of the EU on October 31, come what may…”

The UK PM says that reasons abound for Britons to have a confident view on the path that the country is taking. He also lambasted the UK Parliament in quotes taken from Reuters:

“Parliament refuses to deliver Brexit, refuses to do anything constructive and refuses to have an election…things have not been made easier by the surrender bill.”

PM Johnson has however promised to get a deal done.

However, a spokeswoman for the European Commission has just reiterated the stance taken by the EU for some time now.

“The EU will examine objectively any UK proposals on Brexit,” the spokeswoman said, also stating that while an orderly withdrawal was preferred, the EU wanted a solution that would meet all conditions set for the Irish backstop to secure a deal.

Various EU officials including EU Commission President Jean-Claude Juncker, have criticized the UK for not presenting any concrete proposals on the controversial Irish backstop. Juncker is to speak to British Prime Minister Boris Johnson at 15:15 GMT today.

Download our EURGBP Q4 Outlook Today!

[vc_single_image image=”14654″ img_size=”medium” alignment=”center” style=”vc_box_rounded” onclick=”custom_link” img_link_target=”_blank” link=”https://www.investingcube.com/q4-global-market-outlook-eurusd-gold-crude-oil-bitcoin-sp-500/”]

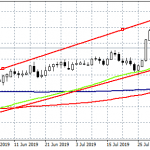

Technical Play for the EURGBP

The Brexit comments of UK PM Johnson must be pleasing to EURGBP bulls, as the pair is trading higher on the day, which continues the near-trend upswing on the pair. This upswing is captured in the rising channel. The active price candle is close to mounting a challenge on the channel’s return line, which touches the R1 pivot at 0.89320 (highs of June 11 and September 12).

A break of the R1 pivot (and consequently the channel) opens the door for a test of the R2 pivot resistance at 0.89799 (multiday highs of June 6-9; June 12-15). Above this level, 0.90227 (August 27 and August 30 lows in role reversal) could become a target.

On the flip side, rejection of price at R1 (and the channel’s return line) reopens the door for a downside test of the 0.88892 central pivot mark and possibly the channel’s lower border of 0.88606 below it.

This is the critical month for Brexit. With 29 days to go, EURGBP will certainly experience more volatility from Brexit related headlines.