- EURCAD pair was looking to move higher with both Europe and Canadian central bank members meeting to discuss interest rates.

The EURCAD pair was looking to move higher with both European and Canadian central bank members meeting to discuss interest rates. Both meetings are not expected to see a cut in interest rates, but traders will watch the statements closely for signs of future policy and potential stimulus.

Canada meets today and rates are currently 0.25%. It’s possible that a cut could come from Canada, while European rates are at 0% and the bank is not expected to go lower before next year.

Oil prices have been a weight on the CAD in recent sessions and this may factor into the central bank policy. Crude saw a high of $43.75 on August 26th and the price has since tumbled to $37.25. This could be a drag on the economy going forward and Canada’s unemployment rate is currently stuck above 10.2%.

The recent statement from the Federal Reserve regarding lower rates will likely be emulated by the BoC and traders will have to watch the bank’s comments to gauge the future path for inflation and policy for the Loonie currency. Brexit talks are back in the news and this adds some headline risk to the Euro ahead of tomorrow’s central bank decision.

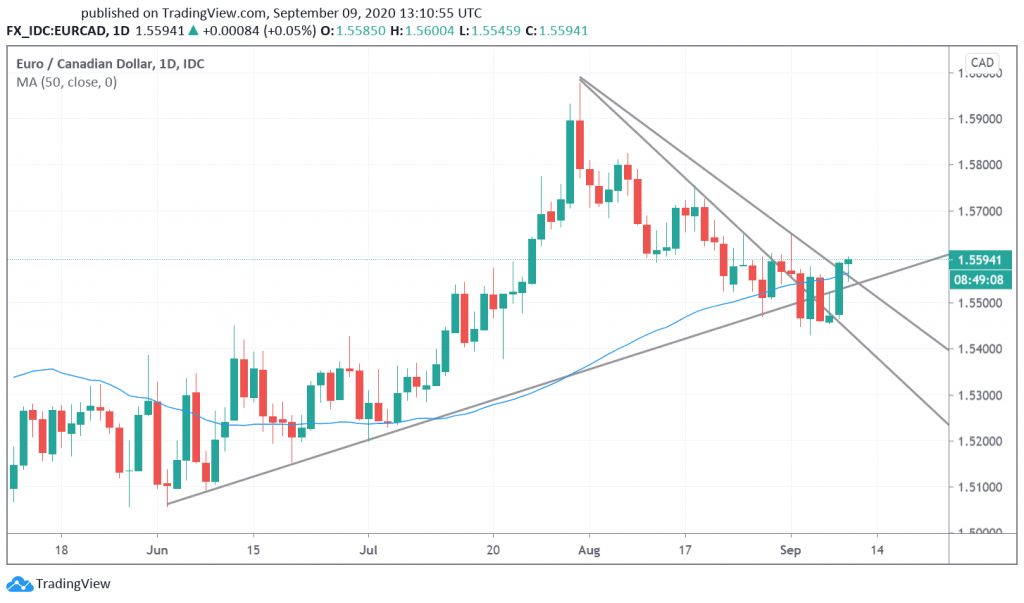

EURCAD Technical Outlook

The EURCAD was attempting a bullish move higher but the pair is still flat on the day. Yesterday’s move higher is a key break from uptrend support and the Euro has also cleared the 50 day moving average. A move to 1.57450 is possible with stops placed around 1.5420. The Investing Cube team is now available for Trading Coaching.

EURCAD Daily Chart