- Accelerated US Dollar strengthening ahead of the FOMC minutes pressurized the EUR/USD pair, sending it 0.23% lower on the day.

The US Dollar is strengthening across the board ahead of the FOMC minutes, due out in 2 hours from now. This situation has forced the EUR/USD below the 1.18 price mark, hitting 3-month lows.

The FOMC had released a hawkish statement from the 16 June meeting. The market is waiting to see the context in which that statement was put out, judging from the responses of several board members who attempted to downplay the hawkish comments after that.

The FOMC statement of 16 June caused the US Dollar to soar broadly, and perhaps the market expects the FOMC minutes to mirror this statement, driving demand for the greenback. The EUR/USD is currently down by 0.19% as it marks a third straight day of losses on a firmer greenback.

Technical Levels to Watch

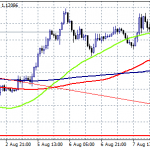

The EUR/USD is challenging the support at 1.18008 and has indeed violated this price level intraday. However, confirmation of this breakdown is needed before the pathway clears for a move towards the 1.17505 support level (11 November 2020 and 2 April lows). Below this level, 1.17036 (31 March low) forms an additional downside target.

On the flip side, a bounce on the 1.18008 support allows the pair to recover, targeting 1.18395 initially before 1.18927 and 1.19472 come into the picture as additional targets to the north. Upside bias is restored if the price attains 1.2000, which clears the high of 25 June at 1.19753.