- Here is the EUR/USD forecast ahead of some key economic data pieces coming out of Germany and the US in a loaded week.

The EUR/USD pair is up 0.5% this Monday as the bulls aim to push a recovery following a brief pause in selling. The pair had surrendered all its initial gains on Friday and ended 0.09% lower following a hawkish tone in the Fed Chair’s speech at the Jackson Hole symposium.

The pair is seeing some upside traction this Monday, which is more of USD bulls taking a breather rather than inherent Euro strength. Indeed, the situation could set up potential rally-selling opportunities, as several investment banks have predicted a EUR/USD rate well below parity heading toward the end of the year.

Additional fundamental triggers for the EUR/USD will be first seen on Tuesday when the German Preliminary Consumer Price Index data will hit the market. The consensus by economists is that the CPI has declined monthly from 0.9% in July to 0.2% in August. An upside surprise gives the European Central Bank some room to raise interest rates when it meets later this month; a EUR-positive scenario. However, the impact is not expected to last, as the US Consumer Confidence data and a series of employment data are due for release this week. Topping the list is the US Non-Farm Payrolls data for August, due for release on Friday, 2 September.

The markets expect a dip in the number of job additions, a cooling of wage inflation and a static unemployment rate.

EUR/USD Forecast

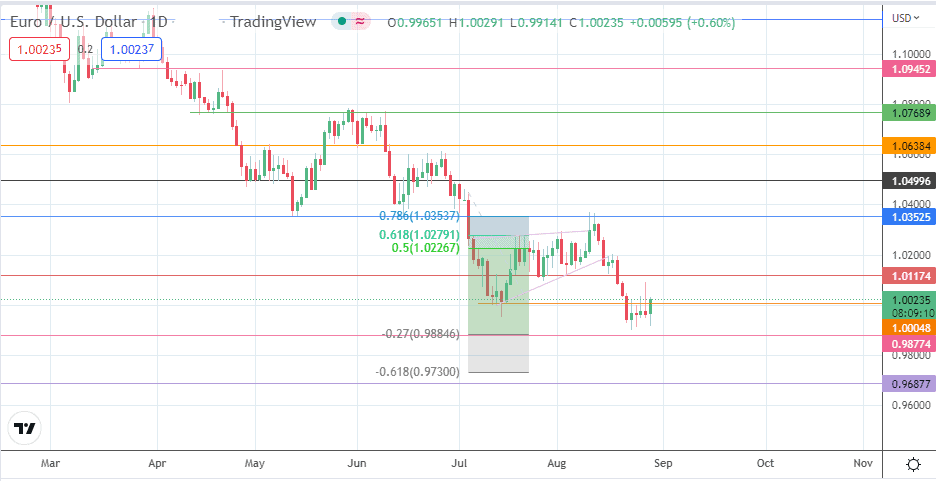

Last week’s price decline found a bottom just ahead of the 0.98774 price level. This move completed the rising wedge pattern on the daily chart and now provides for a possible retracement rally. The intraday recovery is set to test the 1.00048 price level. If the bulls take out this resistance, 1.01174 (13 July high and 3 August low) becomes the next target to the north. There is a psychological resistance at 1.02000, formed by previous highs of 18 July and 18 August. If this barrier is overcome, the 78.6% Fibonacci retracement from the 30 June swing high to the 15 July swing low becomes the new upside target. Of course, the 30 June swing high at 1.04996 forms an additional northbound barrier.

On the other hand, a failed clearance of the resistance at parity allows for a potential rejection and pullback toward the 27% Fibonacci extension point at 0.98774 (16 December 2002 low). If there is further price deterioration, the 0.97300 price support forms the next target, being the site of the 21 October 2002 low.

EUR/USD: Daily Chart