- EUR to GBP exchange rate continues its consolidation in a contracting triangle. In doing so, it offers both a bullish and a bearish opportunity.

In a slow trading environment, the EUR to GBP exchange rate regained the 0.91 level. The move higher came just when the EURUSD reached above 1.18 too, on stronger than expected Italian industrial production data.

Italian Industrial Production Data Smashing Market Expectations

The industrial output in Italy surged to 7.7% MoM on expectations of 1.3%. The data shows a strong comeback for the Italian Industrial Production, an encouraging sign for the post-corona lockdowns world.

On the other hand, the French and German industrial output did not confirm the Italian momentum. Nevertheless, the EURGBP gains were also fueled by the U.K. data disappointing today.

U.K. Data Misses Expectations

Construction output, Industrial Production, and the Manufacturing Production – they all missed the forecast today. The sharpest deviation from the expectations came from the Manufacturing Production, coming out at 0.7% when compared to 3.2%.

All in all, a mixed picture from the mainland Europe, and a bleak perspective from the United Kingdom. Hence, the resilience in the EUR to GBP exchange rate makes sense.

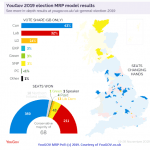

EUR to GBP Technical Analysis

The EURGBP currency pair is at crossroads here. The recent move above 0.91 did not break the triangular pattern it formed recently. As such, the triangle provides an opportunity for both bulls and bears to trade a breakout.

Bulls want to see the upper edge of the triangle to be broken. At that point, going long for the most recent higher high makes sense only if bulls place a stop loss order at the point where bears would want to go short.

That is, when the market breaks the lower edge of the triangle. And, at the same time, the series of lower lows. In this case, bears should target the 0.89 level, which corresponds to the previous low. Also, the invalidation for the short trade comes at the point where bulls may want to go long.