The EUR/JPY price has surged to the highest point since 2015 as the Japanese yen sell-off intensifies. The EUR to JPY exchange rate is trading at 142.76, which is about 30% above the lowest point in 2016. It has risen by over 16% from the lowest level this year. The same is true with other pairs like the USD/JPY, AUD/JPY, and CHF/JPY.

ECB and BOJ divergence

The EURJPY price has been in a strong bullish trend in the past few months as the European Central Bank and the Bank of Japan take different paths. The BOJ has become an outlier among most central banks as it has maintained a dovish tone this year. It has left interest rates unchanged and hinted that it will soften monetary policy more.

The ECB, on the other hand, has taken some measures to fight inflation. It has partially ended its bond-buying program and hinted that rate hikes are on the way. This week, Christine Lagarde reiterated that the ECB will start hiking interest rates in July this year. Analysts are expecting either a 0.25% or 0.50% rate hike as the bank battles inflation.

Still, the BOJ and ECB have some similarities. For one, their respective economies are not doing well. Japan is expected to have the slowest recovery in the G7, while some EU members like Spain and Italy are vulnerable to high inflation.

EUR/JPY forecast

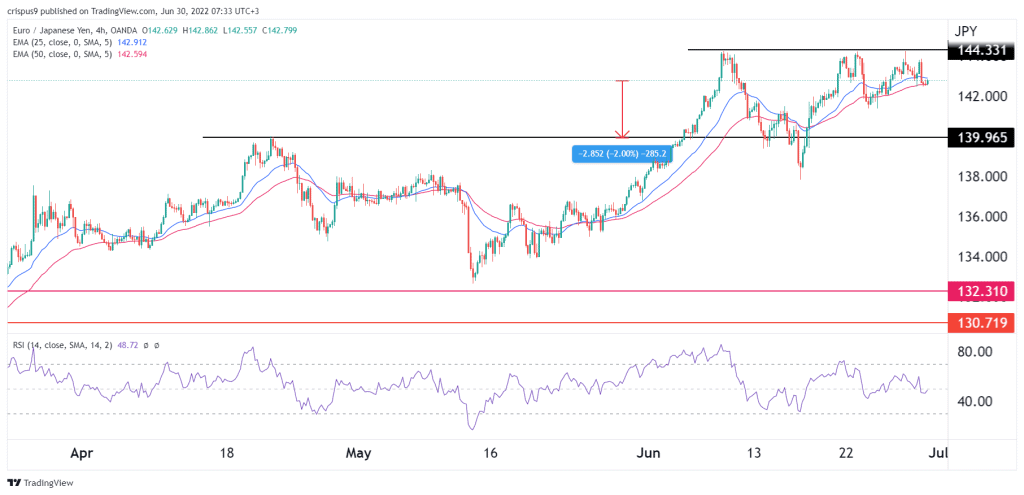

The four-hour chart shows that the EUR to JPY price has recently been in a strong bullish trend. The pair has found strong resistance at about 144.33 level and formed what looks like a triple top pattern. It is also hovering near the 25-period and 50-period moving averages while the Relative Strength Index (RSI) has moved to the neutral point.

Therefore, because of the triple-top pattern, the outlook for the EURJPY in July is bearish. If this happens, the next key support level to watch will be at 139, about 2% below this level. A move above the resistance at 143.52 will invalidate the bearish view.