- The EUR/JPY is up 0.52% this Friday, but technical plays will determine short term direction even as it looks to end the week lower.

Overall, Euro weakness remains on the cards, but other factors could decide its short-term direction. Ahead of the speech by Fed Chair Jerome Powell at the ongoing Jackson Hole symposium, Euro bond yields are inching higher, and this is providing support for the single currency.

Ten-year yields on the German Bund instrument, which serves as the benchmark for Eurozone bonds, are up 2.5 bps, continuing an upward streak after it hit six-week highs at 1.39% on Thursday. Italian bond yields were up 7 bps to 3.62, widening the spread between the German and Italian 10-year yields to 227 bps.

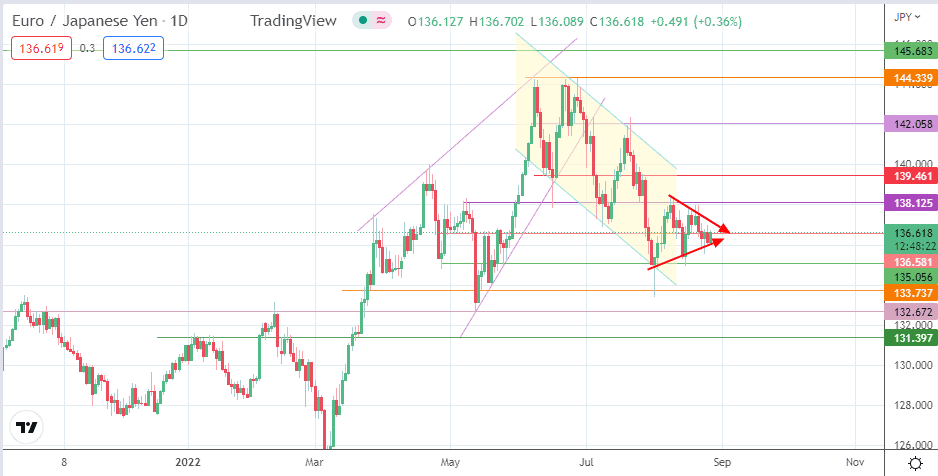

From the technical analysis standpoint, the EUR/JPY will rely on the resolution of the evolving symmetrical triangle to show the way to price action heading into the new month. The EUR/JPY is up 0.52% this Friday, but remains 0.44% lower this week.

EUR/JPY Forecast

The evolving symmetrical triangle within the context of the descending channel remains the pattern of note to decide the short-term direction. A breakdown of the triangle must be followed by a degrading of the support at 135.056 for the bears to have access to the 133.737 (26 March lows) and 132.672 (11 February high and 12 May low) support levels. The latter marks the completion point of the measured move of the triangle.

On the flip side, a break of the triangle to the upside follows the uncapping of the 136.581 resistance (3 May low, 18 May high and 18 August low). The 138.125 resistance, formed by the previous highs of 6 May and 10 August, forms a barrier to the pursuance of the pattern’s completion at 139.461 (13 June low and 27 July high). Above this level, additional resistance is seen at 142.058, the site of the 7 June, 17 June and 20 July highs.

EUR/JPY: Daily Chart