- Mixed inflation data from the Eurozone fails to provide a clear pathway for ECB action, which could lead to a EUR/JPY correction.

The EUR/JPY pair is slightly lower after Eurozone inflation data largely met expectations. The monthly and annualized figures for the Core Consumer Price Index data came in at -0.2% and 4.0%, respectively. Both figures met expectations, indicating that while inflation had fallen from June to July, it rose yearly.

The same situation was seen with the headline figures, as the annualized CPI for July came in at 8.9%, representing a 3-percentage-point increase on a year-on-year basis. The HICP (ex. food and energy prices) rose from 4.6% to 5.1% year-on-year but fell monthly from 0.4% in June to 0.2% in July. The monthly figure fell from 0.8% in June to 0.1% in July, matching expectations.

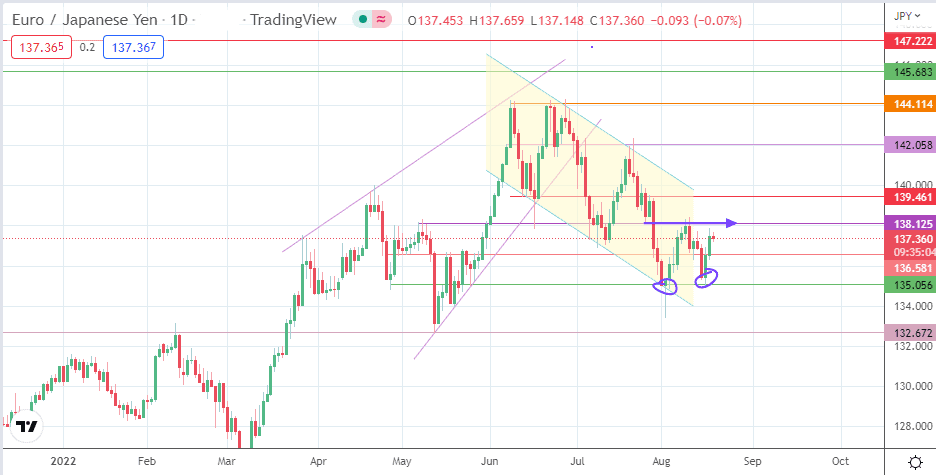

The mixed inflation data does not provide a clear pathway for the European Central Bank’s (ECB) next move in rate adjustment. With the pessimistic view of the Eurozone economy held by several investment banks, and Rabobank’s downgraded outlook for the Euro, the EUR/JPY will need tailwinds from another source if it is to continue the two-day recovery. This recovery has now faltered below the 138.125 price mark, serving as the evolving pattern’s neckline.

EUR/JPY Forecast

The evolving double bottom pattern requires the bulls to break the 138.125 resistance, formed by previous lows of 16 June and 26 July, for the pattern to be complete. This scenario would see 142.058 (7 June and 20 July peaks) becoming the completion point of the breakout move.

For this to happen, the bulls must take out sequential barriers at 139.461 (13 June low and 27 July high) and the 140.00 psychological price mark. Above this level, the 2022 high at 144.339 (28 June high) becomes the new target.

On the flip side, failure to breach the neckline at 138.125 could lead to a rejection and pullback move that targets 136.581 (2-4 May and 18 August lows). Below this level, additional support targets are found at 135.056 (25 May and 16 August lows), and the 134.00 psychological support, which is formed by previous lows of 28 March and 19 May 2022. The low of the 12 May 2022 candle at 132.672 forms another target to the south.

EUR/JPY: Daily Chart