- The EUR/GBP is set for a third big day of gains after higher than expected inflation data from Germany heighten ECB rate hike prospects.

The recent selling onslaught on the British Pound and expectations of a rate hike by the European Central Bank following data that shows an unabated increase in Eurozone consumer inflation are the factors driving the EUR/GBP’s uptick. The EUR/GBP is up 0.38% this Tuesday and looks set to end the session with a 3-day winning streak.

Hawkish comments from ECB policymaker Martins Kazaks and the German Preliminary CPI data showing a 7.9% increase in consumer inflation (7.8% consensus) were the bullish triggers for the Euro. Kazaks, who had called for ECB tightening in June (that materialized), now says a significant rate hike is needed in September. Kazaks opines that the ECB should “be open to discussing 50 and 75 bps as possible moves”.

With German CPI data showing an annualized increase in the consumer price index of 7.9% (versus a consensus of 7.8%), the appears to be a heightened expectation that the ECB has a window of opportunity to drive interest rates higher before recessionary risks appear.

On the other side of the divide, the UK’s cost of living crisis continues to weigh heavily on the Pound, even as the UK’s energy regulator predicts an 80% rise in household energy bills by October. The Pound had already been struggling after the Bank of England’s pessimistic outlook on inflation and the UK economy’s growth prospects after its last meeting. The situation sets the tone for a further push to the north by the EUR/GBP.

EUR/GBP Forecast

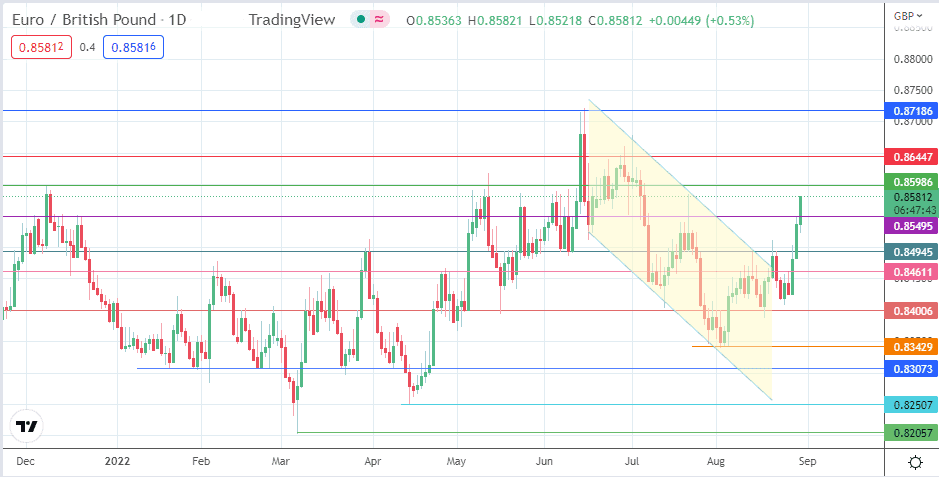

The 0.85986 resistance level is the next target for the bulls. A break of this barrier clears the way for the bulls to aim for 0.86447 (28 June high). The 15 June high at 0.87186 awaits if the advance continues above this barrier.

Conversely, rejection at 0.85986 temporarily halts the advance, providing a chance for a corrective decline toward 0.85495 (30 June low and 29 August high). Below this level, additional support levels are seen at 0.84945 (21 July low and 12 August high) and 0.84611, where the 9/25 August highs form role-reversed pivots. An additional decline sees the psychological price level at 0.84006 become a new target, followed by 0.83429 (4 August 2022 low).

EUR/GBP: Daily Chart