Last week’s selling in Ethereum has added downside pressure to the coin and we could see further losses ahead. ETH saw an end to a sharp rally in cryptocurrencies after Bitcoin rallied on weakness in the U.S. Dollar.

The greenback saw a rally which lasted around a week and this put pressure on commodities with a drop in gold, silver and oil. The dollar will be the key risk for cryptocurrencies in the near-term and this week sees key data from the U.S. economy that could drive the next direction.

Tomorrow sees the release of U.S. retail sales data and the latest interest rate decision from the Fed. Retail sales are expected to grow 1% after consumers got back to spending after the easing of virus lockdowns. The Federal Reserve will be unlikely to make any surprise move on interest rates and traders will be more concerned about the economic projections that are released with the rate decision. This could see volatility in the dollar and be a market-moving moment for cryptocurrencies.

Ethereum is approaching the V2.0 upgrade which is aimed at making the coin’s blockchain faster and more scalable. This will be a boost for ETH with the growing DeFi projects that have been listing their native tokens on the ETH blockchain but we are maybe still early in the adoption phase for decentralized finance (DeFi) as a mainstream financial options.

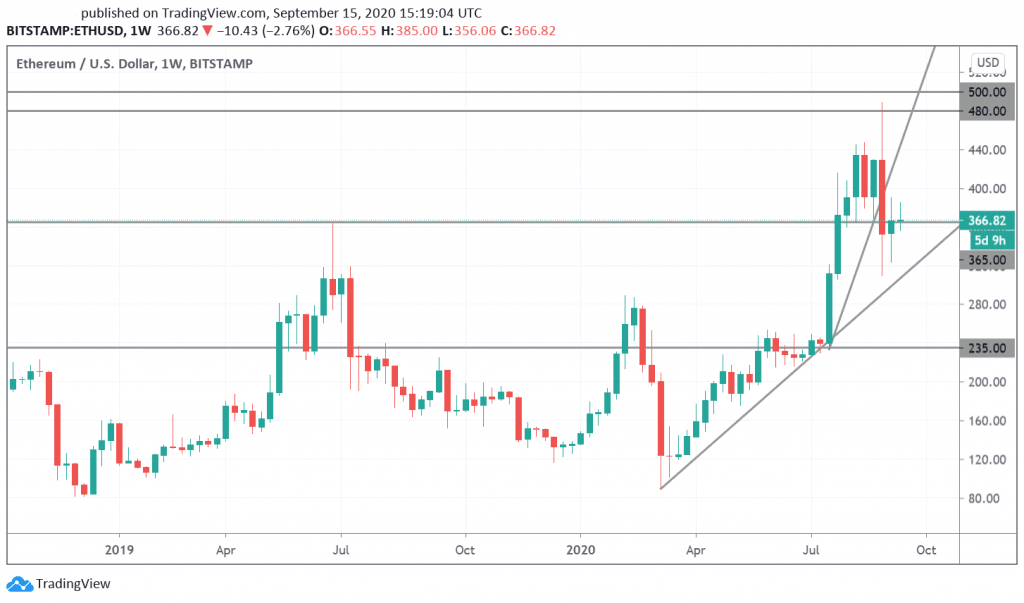

Ethereum Technical Outlook

Ethereum’s sell-off last week hints that further losses are ahead. The price is sitting at key resistance around the $365 level, which marked the June 2019 high. If Ethereum falls under this level then the coin could drop to $235. The Investing Cube Trading Course is available for traders looking to build their skills in technical analysis and risk management.

Don’t miss a beat! Follow us on Telegram and Twitter.

Ethereum Weekly Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.