- The Ethereum price is capped by profit-taking above $4,000, as growing macro headwinds shatter the bulls confidence.

The Ethereum price is capped by profit-taking above $4,000, as growing macro headwinds shatter the bulls confidence.

Ethereum (ETH) continues to change hands on either side of September’s four-month high, in muted, directionless trade. But whilst the recent poor performance has undoubtedly dented the chances of ETH reaching $5,000 in the near term, buyers are present scale-down. As a result, rallies above $4,000 are sold, whereas dips to $3,600 are bought.

The cryptocurrency market faces several potential obstacles in the coming months. Firstly, many central banks are moving towards tightening cycles to combat runaway inflation. Furthermore, the Omicron variant risks global GDP in the coming months. However, the biggest threat to the Ethereum price is Bitcoin. Despite dropping 30% from November’s high, BTC still feels heavy. If Bitcoin cannot find some bullish momentum, it will weigh heavily on Ethereum and the broader market.

ETH Price Forecast

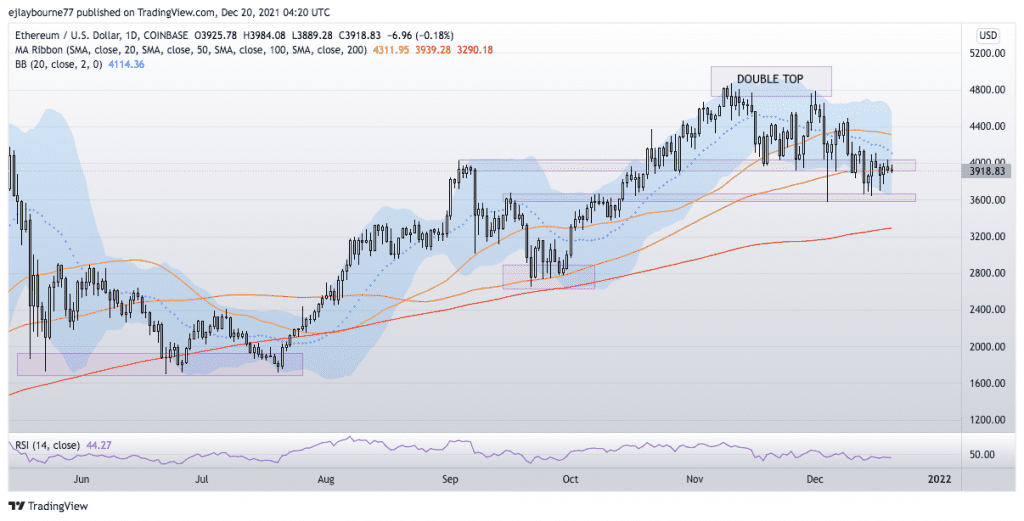

The daily chart shows the Ethereum price is trading at $3,918, just below the 100-Day Moving Average at $3,920. Notably, the price has extended below the indicator several times recently before bouncing from the support of the October highs between $3,575-$3,600.

Considering the growing risks, I expect ETH will soon retest the $3,600 support level. Furthermore, a broader risk-off approaching year-end could drive the price down to the 200-DMA at $3,290. In contrast, $2,800 is achievable longer-term if the macro picture continues to deteriorate.

I maintain my overall bearish view and $3,200-$3,300 price target in Q1. However, a daily close above the December 9th high of $4,490 opens the door to $5,000, invalidating my bearish thesis.

Ethereum Price Chart (daily)

For more market insights, follow Elliott on Twitter.