- EasyJet share price has come under intense pressure in the past few months even as international and regional travel demand rises

EasyJet’s share price has come under intense pressure in the past few months, even as international and regional travel demand rises. The EZJ stock is trading at390p, which is close to its lowest level since June 2012. It has fallen by over 58% from its highest point in 2021 and by75% from its all-time high. As a result, its market cap has retreated to about 3 billion pounds.

EasyJet costly mistake

In general, EasyJet has been a terrible investment for most people. As such, many investors believe that the company made a mistake when it turned down an acquisition bid by Wizz Air. In fact, the stock has dropped by more than 45% since that time. The management said that the bid severely undervalued the company.

EasyJet, like other airlines, has gone through a difficult time during the Covid-19 pandemic. Recently, however, the firm has seen its business rebound as demand for air travel rebounds. The company carried over 22 million customers in the most recent quarter, which was about 87% of 2019 capacity.

Its load factor has moved close to 92% while the number of flights rose to 140,045 in the quarter. Further, its revenue rose to 1.75 billion pounds

At the same time, the rebound in travel has coincided with a sharp in fuel prices and a dramatic climb in the US dollar. The jet fuel price has more than doubled while the dollar index has risen to the highest point in over 20 years. The company booked a 36 million pound loss in the most recent earnings due to currency conversions. The CEO said:

Despite the loss this quarter due to the short-term disruption issues, the return to flying at scale has demonstrated that the strategic initiatives launched during the pandemic are delivering now and with more Page 2 of 4 to come.”

Despite the progress, many investors believe that EasyJet made a costly mistake by rejecting the acquisition by Wizz. They believe that the stock will have difficulty returning to pre-pandemic levels. Also, if another offer comes up, it will likely be significantly smaller than that made by Wizz.

EasyJet share price forecast

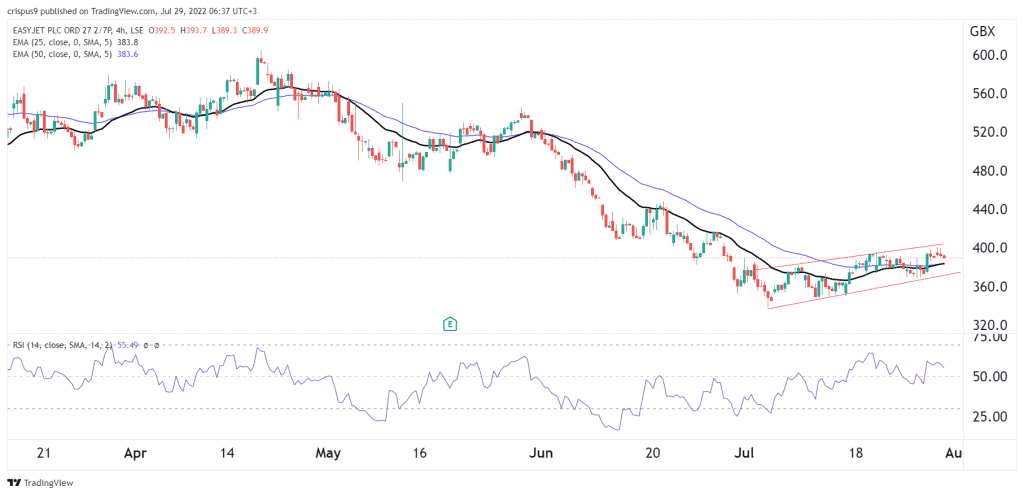

The four-hour chart shows that the EZJ stock price has been in a slow recovery trend in the past few days. It has managed to move from the YTD low of 336p to the current 388p. The shares have formed an ascending channel pattern along the way while the Relative Strength Index (RSI) has moved above 50.

Therefore, I suspect that the shares will have a bearish breakout in the near term. If this happens, the next key support level to watch will be the YTD low of 336p. A move above 400p will invalidate the bearish view.