The Dow Jones Industrial Average (DJIA) looks set for another rally, as there has been no negative news from the US-China trade war front. In a radio interview granted yesterday, US President Donald Trump hinted that trade talks with China would move to “a different level”. This was after the Chinese Commerce Ministry had posted conciliatory remarks, stating the willingness of Beijing to negotiate with Washington in a tranquil atmosphere.

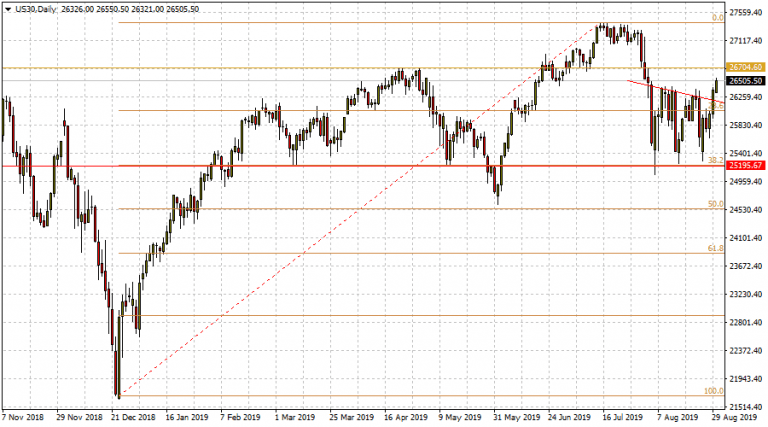

Traders loved the tones of the statements from both sides of the divide, and the DJIA edged past the 26,000 mark, which took it above the neckline in the triple bottom formation that has been in evolution since the end of July 2019.

Today’s price action has been very positive so far. The Dow Jones futures asset is trading at 26,503, which shows an upside continuation of the breakout move from the neckline on the triple bottom. The measured move from the lowest bottom to the centre of the midline is about 1,147 points, so the projected price move from the neckline to the upside should take the Dow Jones futures to the highs seen on July 17 at 27,382.

However, it must be noted that there are several pitstops along the way and that this will not be a straight forward move. The US-China trade impasse is still far from being resolved and at any point in time, risk-off sentiment could send the Dow tumbling to any of the nearby support areas.

I expect the Dow to test the 26,704 area as the initial resistance (April and June 2019 highs), with further resistance at 26,978 (July 5 highs). On the flip side, risk-off sentiment may allow the Dow to retest the neckline anywhere around 26,000 – 26,250.

A lot of the moves on the Dow will depend on the US-China trade talks and the comments from the principal players on both sides. The price action will therefore remain fluid going forward.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.