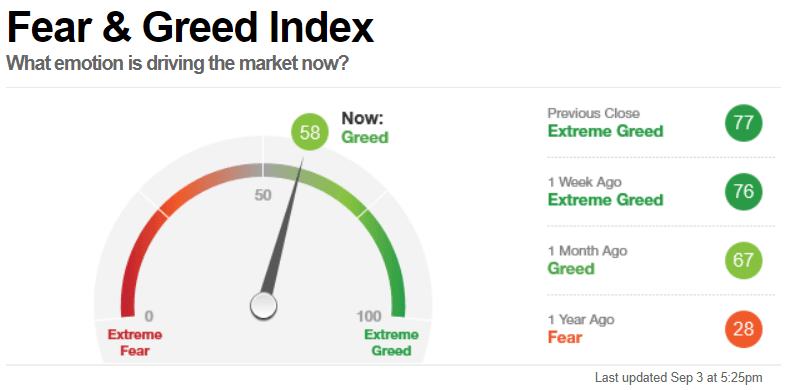

- Dow Jones index is rising today as traders attempt to buy the dip. The fear and greed index on Monday was in the extreme greed section

The Dow Jones is paring back some of the losses it made yesterday. The index is up by more than 0.43% in the futures market. Similarly, futures tied to the S&P 500 are up by 0.20% while those tied to the Nasdaq 100 are down by 0.67%. Meanwhile, the fear and greed index, which was in the extreme greed zone earlier this week, has moved back to the greed level.

Fear and greed index was right

On Monday this week, I warned about a likely correction in US stocks. I based this argument on the fear and greed index, which had turned to extreme greed. For starters, this is an index that measures the sentiment in the market by comparing several aspects. These are the put and call options, junk bond demand, market momentum, stock price strength and breadth, safe haven demand, and market volatility.

When the index is at extreme greed level, it is usually a sign that investors are buying as much stocks as they can. This tends to lead to bubbles, especially in the technology sector. As I wrote earlier today, the market capitalisation of the five biggest tech companies in the US had reached a whopping $8 trillion.

At the same time, the Dow Jones crossed the $29,000 level this week. As such, an expansive fear and greed index and the Buffett indicator, together with the psychological level of the Dow Jones was a recipe for a correction.

So, Buy the Dip?

The fear and greed index is now pointing to greed. When stocks are in a rallying mode, this is usually a sign that the rally will continue as they attempt to enter the extreme greed level. However, the current situation means that the Dow Jones, the Nasdaq 100, and the S&P 500 indices could continue to fall as retail investors get more fearful.

Still, the upcoming nonfarm payroll data could change the situation. A very good number will possibly be bearish for the Dow Jones because it will increase the possibility of a V-shaped recovery. Such a recovery will likely bring the next rate hike closer than what analysts are expecting.

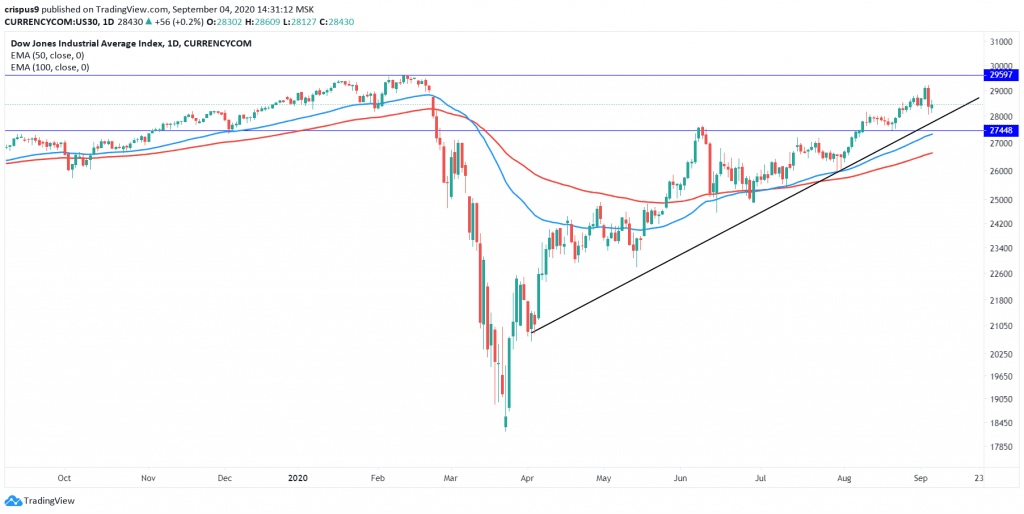

Dow Jones technical outlook

The Dow Jones futures are trading at $28,582, which is still substantially lower than this week’s high of $29,200. On the daily chart, the price is above the short and medium-term moving averages. It is also above the ascending trendline that connects the lowest levels in April and July.

Therefore, in the medium-term, I suspect that the index will drop slightly as bears attempt to move to the psychological support at $28,000. On the flipside, a move above this week’s high of $29,200 will invalidate the dead-cat-bounce thesis.

Dow Jones Daily Chart