- Made.com share price plunged to an all-time low as the company went out of business. The stock crashed to $0.35. What next?

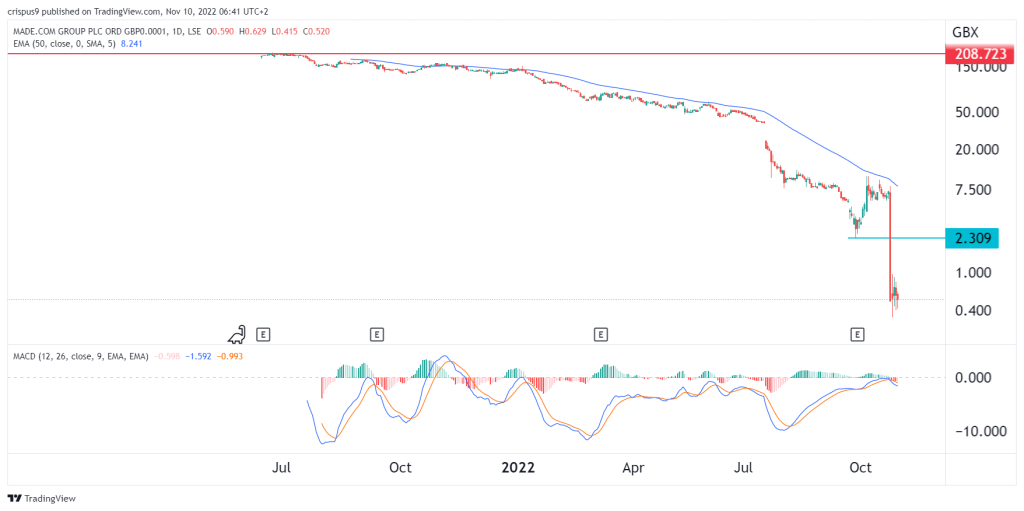

Made.com share price plunged to an all-time low as the company went out of business. The stock crashed to $0.35, which was significantly lower considering that it was trading at $208 in 2022. So, what next for the furniture and home furnishings company?

The writing was on the wall

Made.com was one of the top UK startups that went public in 2021 as demand for technology stocks rose. At the time, the company’s market cap surged to more than 775 million pounds. It raised 100 million pounds during its IPO. Other companies that went public during the period were Wise, DarkTrace, and Deliveroo.

Made.com has moved from one crisis into another as a publicly-traded company. Its sales have continued slowing down while the cash incinerator got hot. As a result, the management managed to use all the cash they raised during the IPO in less than 2 years. Made.com share price has been in a freefall since the company went public.

The signs of Made.com’s collapse were clear. A few weeks ago, the company decided to suspend new orders as it attempted to find a buyer. The search proved extremely difficult and the company decided to sell its brand name and intellectual property to Next.com. Its other assets are now being sold by PwC, with the proceeds set to go to its creditors.

Other e-commerce companies in the UK and abroad have come under pressure in the past few months. For example, in the United States, Wayfair stock price has crashed by more than 88% in the past 12 months, giving it a market cap of over $3 billion. Similarly, in the UK, shares of companies like Boohoo and Asos have crashed.

What next for the Made.com share price?

The Made.com share price has been in a strong freefall in the past few months. Now, with the company in administration, it means that the stock is now worthless. As such, there is a likelihood that it will be delisted from the London Stock Exchange. Therefore, it would be highly risky to buy Made shares even as they look incredibly cheap.