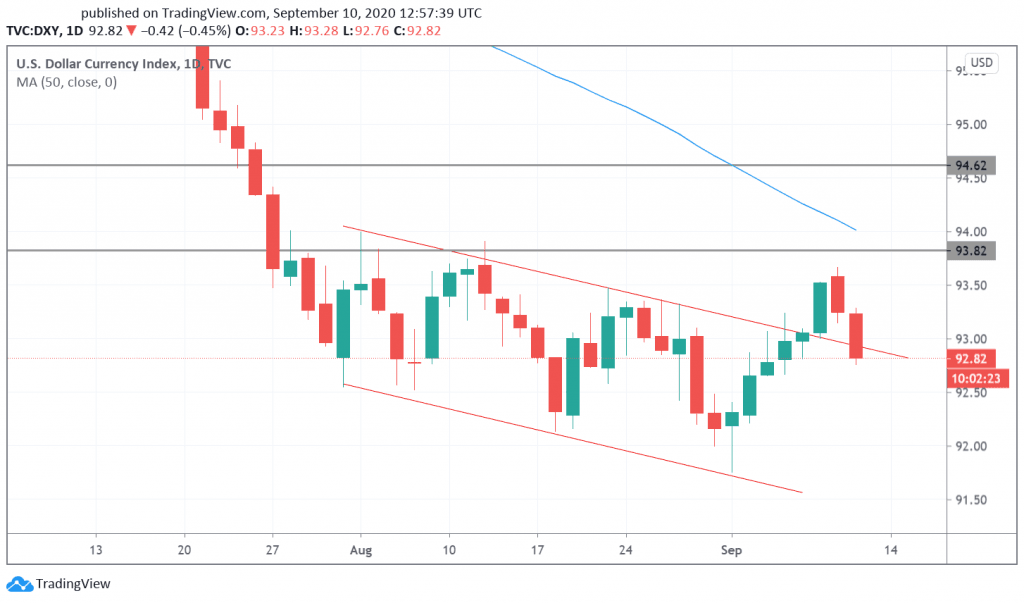

- USD index has stalled at resistance after a six-day rally with potential for a resumption of the USD weakness that drove commodities higher in the summer.

The US Dollar index has stalled at resistance after a six-day rally and there is potential for a resumption of the USD weakness that drove commodities higher in the summer.

The USD had gained on economic data from the U.S. last week, but after losses of 10% since the virus panic-selling highs in March, there is still a chance that the latest rally was a smaller bounce in a protracted downtrend.

Today’s losses are being driven by a strong Euro, which was 0.8% higher on the day after the ECB left their stimulus measures at current levels. The Euro makes up over 50% of the USD trade-weighted index and this is dragging down the price. The market was not expecting any action on interest rates, but there was a possibility from an expansion in the size of the bond-buying program, or an extension in its length from next summer.

The market was anticipating talk of the Euro’s appreciation at the press conference and President Christine Lagarde noted that the bank was watching currency appreciation, but that the ECB, “doesn’t target FX”. This saw the Euro surging after traders feared a currency war between the United States and the EU. Attention will now turn to tomorrow’s core CPI inflation numbers but the ECB may have lit a fire under the Euro once more and this puts the US Dollar index at risk.

Dollar Index Technical Outlook

The US Dollar index saw a six-day rally from support and IT looked like a test of 94.00 was imminent. Prices have stalled at the 93.50 level and the price is heading back into the downward price channel. A daily close could see a resumption of the downtrend. The target would be the 91.75 lows, while a close above 93.50 would signal the uptrend was still alive. The Investing Cube team are available for Trading Coaching. Please see more details here.