- The DiDi Global stock price prediction is for an additional advance on the stock following Monday's 24% gain.

The steep spike and subsequent intraday selloff that left DiDi Global Inc stock with gains of 24.32% on Monday has left many wondering what the new DiDi Global stock price predictions will be. However, the stock is up 5.7% in Tuesday’s premarket trading, which raises the chances of the DiDi Global stock price predictions heading to the bullish end of the spectrum.

The stock surged on Monday following a Wall Street Journal report that Chinese authorities would lift the regulatory ban on the addition of new users to the ride-hailing platform. As a result, the Beijing-based company’s stock saw its trading volume soar to 240.5 million shares, allowing it to record the third-highest daily gain since its public listing 11 months ago. The stock is now close to trading at two-month highs after losing a third of its value in the last three months.

DiDi Global stock price predictions have been bearish since Chinese regulators commenced a cybersecurity probe into the ride-hailing giant a year ago. The investigation was part of a broad clampdown on tech companies by regulators. A lifting of the restrictions will allow the company to list its app in domestic app stores and enable it to enrol new users.

DiDi Global Stock Price Prediction

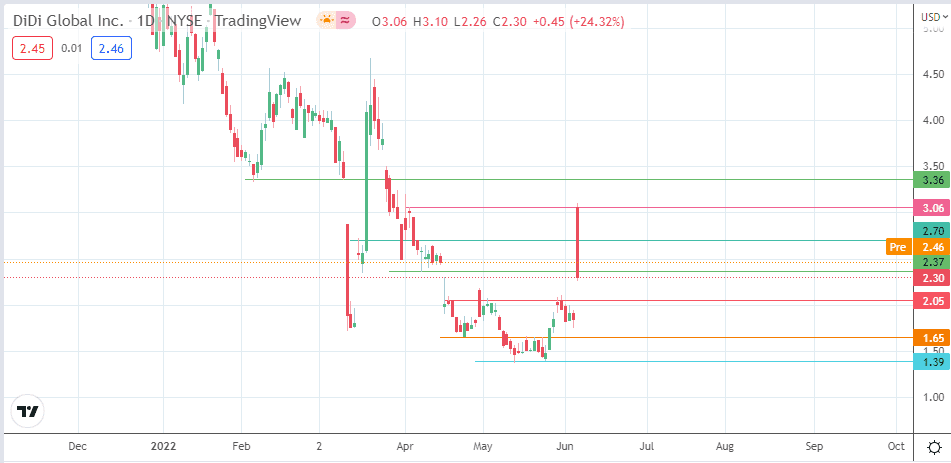

Monday’s high of 3.06 (4 April high) served as the rejection point for the move to the south. The decline has broken down the support levels at 2.70 and violated the 2.37 pivot. An open at the premarket price of 2.47 preserves the 2.37 pivot (7 April low) and could provide for a retest of the 2.70 price mark, serving as a resistance formed by the prior high of 6 April 2022. A break of this price mark opens the door to the 3.06 resistance target. 3.36 serves as an additional target to the north.

On the flip side, an extension of the decline below 2.37 with a 3% penetration close confirms the breakdown of this pivot. It opens the door towards the 2.05 (20 April and 3 May 2022 highs), possibly extending towards 1.65 (25 April low and 17 May high) if the price deterioration is extensive.

DIDI: Daily Chart