- Deliveroo share price has struggled in 2022 as demand for food delivery stocks wane. The stock crashed to an all-time low of 77.48p

Deliveroo share price has struggled in 2022 as demand for food delivery stocks wane. The stock crashed to an all-time low of 77.48p, becoming one of the worst-performing stock in the FTSE 250 index. It has fallen by over 75% from its all-time high. This performance is in line with that of other food delivery stocks like Just Eat Takeaway and DoorDash.

Deliveroo has been in a strong bearish trend in the past few months as investors continued to worry about the rising cost of doing business and low demand as inflation bites. In July, the company said that its gross transaction value (GTV) rose to over £3.56 billion in the first half of the year. That was a 7% year-on-year increase.

In the second quarter, the company’s growth was just 2%, with its UK and Ireland business seeing just a 4% increase. As such, the Deliveroo share price has dropped sharply because investors believe that the company is no longer a growth stock.

Worse, the management decided to lower their guidance for the year. It updated its GTV to grow by between 4 and 12%, which was lower than the previous 15-25% range. The next key catalyst for the Deliveroo share price will be the full results for the first half that will come out on August 10th of this year.

Deliveroo share price forecast

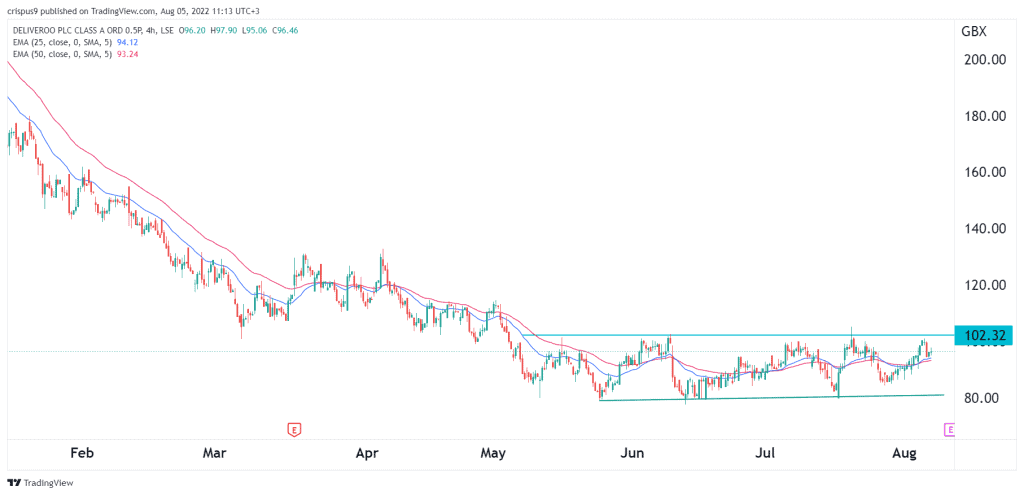

The four-hour chart shows that the ROO share price has been in a tight range in the past few weeks. The stock has remained between the important resistance at 102.32p and 80p. The current price is slightly below the upper side of the horizontal channel.

It has moved slightly above the 25-day and 50-day moving averages. Therefore, the Deliveroo share price will likely continue falling as sellers target the lower side of the channel at 80p. A move above the resistance level at 105 will invalidate the bearish view.