- The RBA lifted the official cash rate by 25 basis points to 3.85%, the first hike since November 2023 and a definitive end to the briefest rate-cutting cycle in modern Australian history.

- Federal Reserve Governor Christopher Waller’s February 4 shift toward a higher “neutral rate” framework has effectively neutralized the RBA’s yield advantage, creating a structural floor for US Dollar strength.

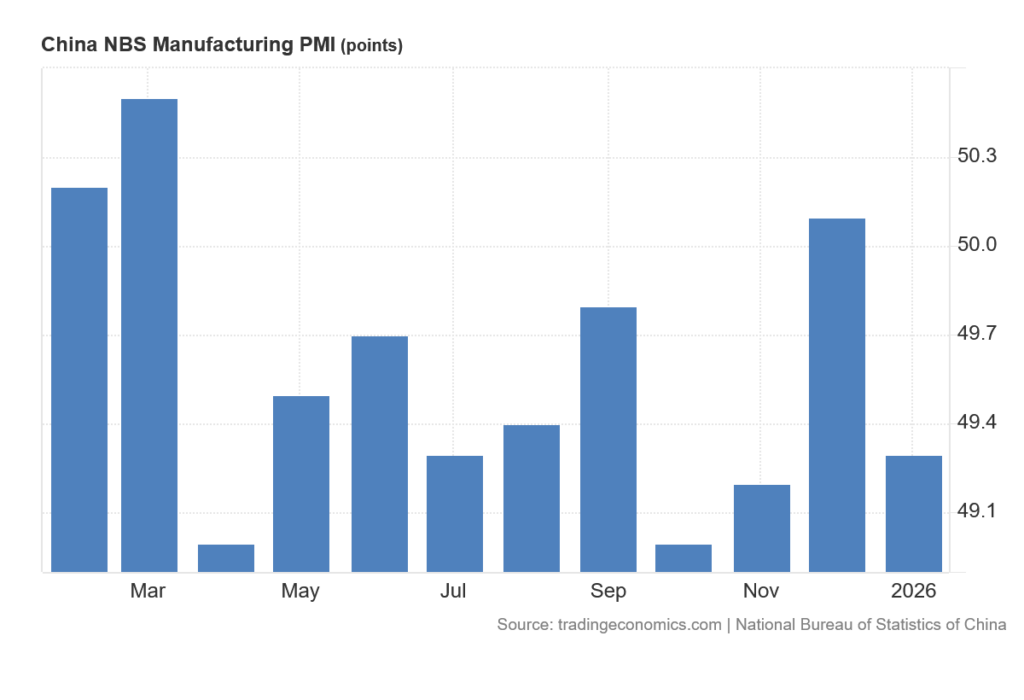

- A critical divergence in China’s January data, where the official NBS Manufacturing PMI fell to 49.3, is stripping the Australian Dollar of its traditional "commodity proxy" premium.

The RBA’s Line in the Sand: A 3.85% Reality Check

The Australian Dollar’s journey in early 2026 has been nothing short of a rollercoaster. On Tuesday, February 3, Governor Michele Bullock effectively tore up the global “easing” script by raising the cash rate to 3.85%. This wasn’t just a standard 25-basis-point adjustment; it was a profound statement of intent and the first time the central bank has tightened policy since November 2023.

With domestic inflation “stuck” at 3.8% and a labor market that shocked the coast by adding 65.2K jobs in a single month, the RBA has signaled it is willing to be the “lone hawk” of the G10. By pivoting back to hikes while peers are still debating cuts, Bullock is drawing a line in the sand to protect the economy from an inflationary “overheat” that many thought was already behind us.

Why AUD/USD Is Falling Despite the RBA’s Hawkish Rate Hikes

Normally, such a move would send the AUD/USD screaming toward the 0.7200 mark. Indeed, on January 29, the pair touched a multi-year high of 0.7093. However, the “Hawkish Aussie Breakout” is currently facing its greatest challenge: a resurgent US Dollar that refuses to yield.

While the RBA is hiking to cool demand, the Greenback is rising on a fundamental repricing of American monetary policy, leaving the Aussie in a state of “bullish exhaustion” as it slides toward the 0.6960 level.

Fed Policy Shift Fuels US Dollar Strength Against AUD/USD

The primary reason the RBA’s hawkishness is failing to propel the AUD higher is a “shockwave” from Washington. On February 4, Federal Reserve Governor Christopher Waller delivered a speech that effectively reset global expectations. Waller didn’t just dismiss a March rate cut; he introduced the framework of a higher “neutral rate”. This suggests that even if the Fed stops hiking, the baseline for US yields is structurally higher than it was in 2025.

This shift has created what Goldman Sachs analysts call a “yield-spread compression.” While the RBA creates a positive carry, the Fed’s shift has widened the expected future path of US yields. The AUD/USD is no longer trading on today’s interest rates, but on the anticipation of a prolonged period of US monetary dominance. This “Waller Shock” has been amplified by the nomination of Kevin Warsh as the next Fed Chair, a move that restored market confidence in the Dollar’s long-term strength.

China’s Manufacturing Slowdown Weighs on the Australian Dollar

Beneath the central bank drama lies a deteriorating foundational support for the AUD: China’s economic pulse. The latest Purchasing Managers’ Index (PMI) data as reported by China NBS Manufacturing reveals a concerning split. While the services sector remains resilient, the official NBS Manufacturing PMI contracted to 49.3 in January. For a “commodity currency” like the Aussie, this is a red alert.

This divergence suggests that Beijing’s stimulus measures are struggling to reach the industrial core, the very sector that drives demand for Australian iron ore and coal. Without the “China tailwind,” the AUD is stripped of its traditional growth-linked premium.

This policy inertia in China, combined with a hawkish Fed, creates a negative feedback loop for the AUD: weaker industrial demand forecasts just as its primary counter-currency reaches peak strength.

AUD/USD Technical Forecast: The 0.6908 “Line in the Sand”

From a technical standpoint, the AUD/USD chart has turned into a battlefield.

- Immediate Support: The 0.6908 level (the February 2 low) is the current fortress for the bulls. A daily close below this would invalidate the ascending channel that has governed the pair since late 2025.

- Resistance Zone: The former 20-day EMA support at 0.6980 has now flipped into a formidable ceiling. To regain its bullish mojo, the pair must reconquer the 0.7000 psychological barrier.

Conclusion: Awaiting the February 13 Verdict

The current 0.6960 level represents a precarious equilibrium. The RBA’s hawkishness is preventing a total collapse, but the Fed’s “shockwave” is preventing a breakout. This sets the stage for February 13, the release of the US Consumer Price Index (CPI).

A “hot” CPI print would validate Waller’s hawkishness and likely crush the 0.6908 support, targeting a slide toward 0.6700. Conversely, a cooler-than-expected print would likely trigger a violent “relief rally” back toward 0.7050. Until then, the AUD/USD remains a “hawkish” currency in a “hawkish” world, struggling to find its footing as the titans of global finance redefine the rules of the game.

Market Note: For a related analysis on how yield spreads and cross-asset signals are driving AUD strength against the Yen, see Michael Abadha’s Cracking the AUD/JPY 2026 Paradox As Gold And Commodities Send Mixed Signals here.

AUD/USD FAQs

The RBA’s hike is being overshadowed by a “hawkish shockwave” from the US Fed. Governor Waller’s move to raise the “neutral rate” estimate has made the US Dollar more attractive on a long-term basis, compressing the yield advantage Australia previously held.

Absolutely. The contraction in China’s Manufacturing PMI to 49.3 signals weaker demand for Australian commodities. This acts as a “hard ceiling” for the AUD, preventing it from fully capitalizing on domestic interest rate hikes.

The CPI will confirm if the Fed’s new hawkish stance is justified. A “hot” reading strengthens the USD and hurts the AUD, while a “cool” reading could spark a sharp recovery back toward 0.7100.