Shares on Germany’s DAX index rose 1.23% on Wednesday, along with its US counterparts, as stock markets cheered the easing of consumer inflation in the US.

The US Bureau of Labor Statistics released data showing that the rate of increase in prices that consumers paid for goods and services (ex. food and energy prices) in July rose by 5.9% annually (consensus of 6.1%) and 0.3% monthly (consensus of 0.7%). The headline number also fell from 9.1% to 8.5% annually to send the DAX to 1-month highs. Other stock indices such as the Stoxx500, FTSE 100, the Zurich SMI and France’s CAC 40 all experienced gains.

Aggressive rate hikes to control spiraling inflation carry a risk of sending economies into recession, stifling jobs growth and economic recovery down the road. Easing inflation obviates the need for such aggressive hikes, which is good for stock markets hence the uptick on the DAX index.

Despite the gains seen on Wednesday that erased Tuesday’s losses, concerns continue to mount on the economic outlook of the Eurozone. But for now, the DAX index can bask in the gains which have sent it to the 13700 mark. Technology, Media and Retail stocks led these gains.

DAX 40 Index Outlook

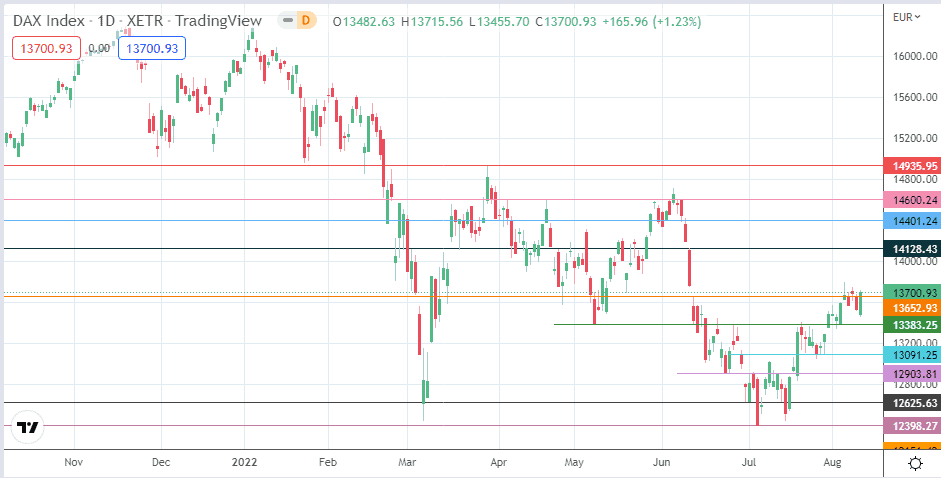

The engulfing pattern on the daily chart has violated the 13652 resistance but requires confirmation from an outside day candle above the recent 4 August high at 13792 to confirm the breakout. This scenario will see the 14128 resistance (2 March and 10 June highs) become the new upside target. If the bulls uncap this barrier, 14401 becomes the next target, being the site of prior highs of 25 March and 9 June 2022. Above this level, additional targets are found at 14600 and 14935 (29 March high).

Conversely, failure to satisfy the price filter breakout condition will lead to rejection and pullback from 13652, leading to a correction that touches off 13383 initially (9 May, 13 June and 3 August lows) before pushing toward 12903. An intervening barrier exists at 13091 (28 July low). Other targets to the south are found at 12625 (1/13 July lows) and 12398 (5 July low).

DAX: Daily Chart