- The DAX has found support and is seeking another leg higher through resistance. The sell-off has been short-lived and traders will be looking to the ECB.

The DAX index has found near-term support and is seeking another leg higher through resistance. The sell-off last week has been short-lived and traders will be looking to the European Central Bank rate decision today for a catalyst.

The ECB are not expected to change their interest rates, however the press conference will be the key event, with officials at the central bank concerned that the Euro is too high and may attempt to “talk it down”. Traders will be interested to hear the thoughts of ECB President Christine Lagarde about the strength of the economy.

The Euro is currently at a two year high and this puts downward pressure on inflation rates, which has turned negative for the Euro and means that they are far from the 2% inflation target that many global central banks have set as an inflation target. It is unlikely that the ECB would conduct an intervention on the currency markets, but it’s possible that they could register their feelings about a higher Euro and threaten a move in the future.

Another option could be some form of additional stimulus or expansion in their bond-buying program that the market would see as being negative for the single currency.

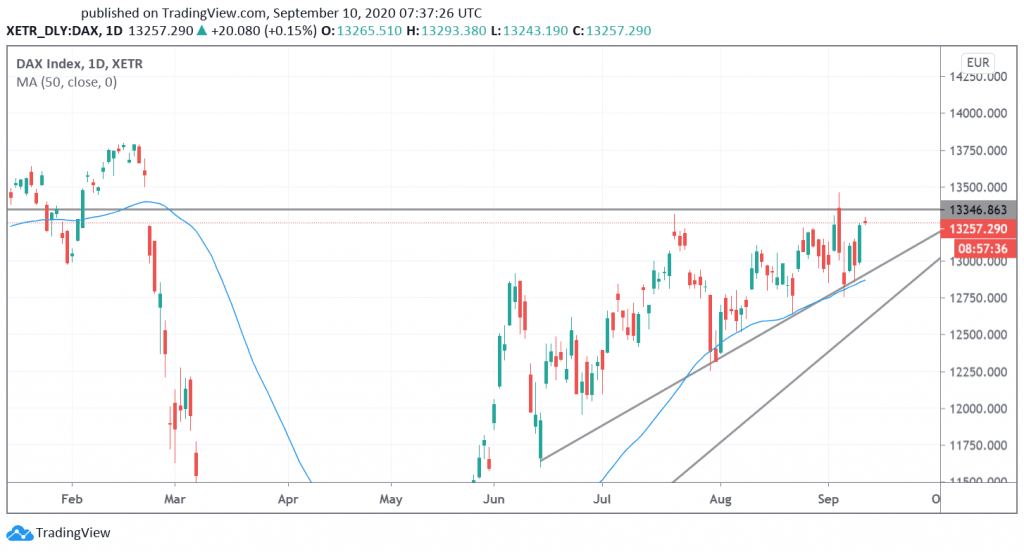

DAX Technical Outlook

The DAX was has found support at the uptrend line from mid-June and this also aligns with the 50 day moving average. The index is now eyeing the resistance at 13,350 that could open up a move to the 13,750 highs from February. Bullish traders should tread carefully as there is still a steep downside risk due to the lack of a larger correction. The Investing Cube team is currently available for Trading Coaching. More details can be found here.