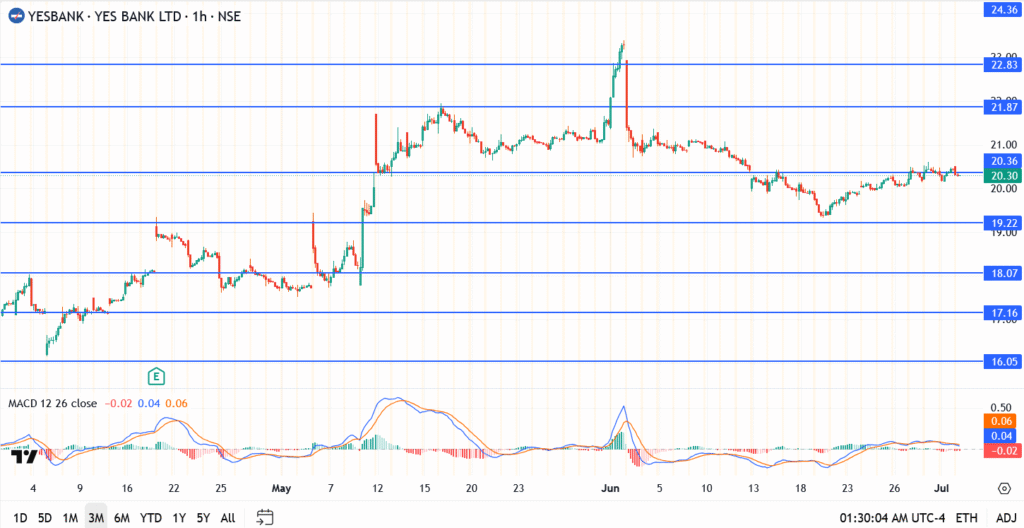

- Yes Bank share price hovers near ₹20.30 as buyers lose momentum below ₹20.50. Key levels hint at a possible breakout or pullback.

Yes Bank shares are trading around ₹20.30 today, with buyers looking a bit exhausted after several failed pushes toward the ₹21 mark. Even though May saw strong institutional interest and the overall banking sector is showing signs of strength, the stock hasn’t followed through. For now, it’s just moving sideways, and that slow drift is likely testing the patience of short-term traders waiting for a clear breakout.

Why Isn’t Yes Bank Moving?

On paper, there’s no major negative news hitting the stock this week. But the momentum has clearly cooled. The rally seen in early June, which took Yes Bank all the way to ₹22.80, fizzled out just as quickly. Since then, buyers have been struggling to push prices beyond ₹20.50, a zone that now acts as a sticky resistance.

Yes Bank Share Price Technical Levels

- Current price: ₹20.30

- Resistance levels: ₹20.50, ₹21.87, ₹22.83

- Support levels: ₹19.22, ₹18.07, ₹17.16

Outlook: Range-Bound, But Ticking Closer to a Break

Yes Bank is still under key resistance, and it feels like a bigger move is brewing, it’s just not clear which way yet. For now, the lack of volume and momentum favors consolidation. Traders should watch for either a confirmed close above ₹21.00 backed by volume, or a break below ₹19.22 which could accelerate downside pressure.

Until then, expect more chop and limited upside unless broader sector flows pick up.