- Top crypto launchpads for IDOs in 2026 focus on risk controls, project vetting, and structured token distribution rather than hype-driven fundraising.

- IDO participation has shifted from speculative bets to selective, data-driven strategies centered on tokenomics, vesting, and post-launch liquidity.

- Multi-chain IDO launchpads dominate 2026, as investors prioritize flexibility, security standards, and sustainable project pipelines.

The crypto fundraising landscape has matured significantly, and in 2026, IDO launchpads remain one of the most reliable ways to access early-stage Web3 projects before they reach public exchanges. However, not all launchpads are created equal. Investors now care less about hype and more about project vetting, allocation fairness, security, and post-launch performance.

As competition for quality deals intensifies, choosing the right IDO launchpad in 2026 can make the difference between sustainable gains and diluted returns. Below is a practical, investor-focused breakdown of the best IDO launchpads in 2026, what makes them stand out, and how to approach them strategically.

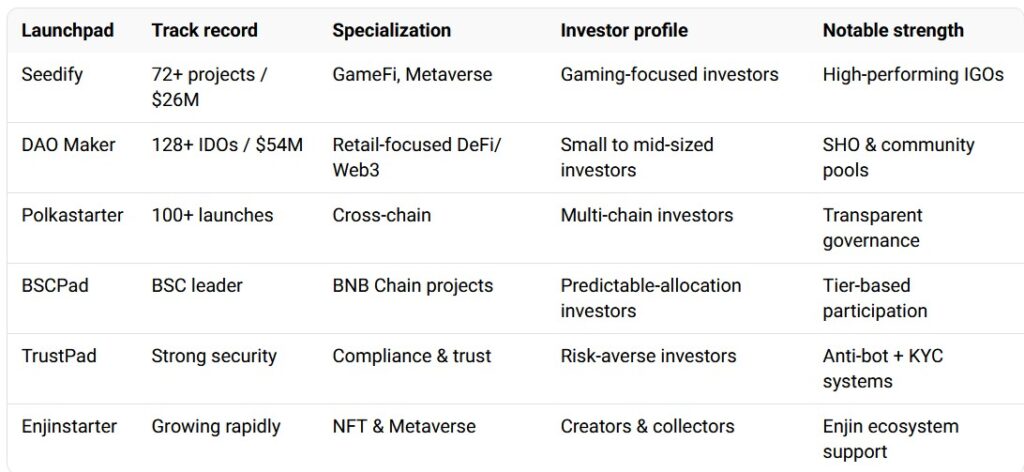

Best IDO Launchpads to Watch in 2026

Each platform below has built a strong reputation through consistent launches, niche specialization, or investor protection frameworks.

Seedify: GameFi and Metaverse-Focused IDO Launchpad

Seedify is commonly referenced among GameFi and metaverse-oriented IDO launchpads in 2026 due to its concentration on Web3 gaming projects. The platform typically works with teams building gaming infrastructure, virtual economies, and metaverse applications.

Rather than functioning purely as a token sale venue, Seedify operates within a broader incubation framework. Projects launched through the platform often continue development post-IDO, though outcomes vary by team execution and market conditions.

Typically attracts:

Participants interested in Web3 gaming, metaverse tools, and interactive digital environments.

DAO Maker: Retail-Oriented IDO Platform With Structured Models

DAO Maker is known for structured fundraising formats aimed at retail participation. Its mechanisms, such as Strong Holder Offerings (SHOs) and community pools, are designed to limit extreme allocation imbalances seen in open sales.

In 2026, DAO Maker continues to host a wide range of Web3 utility and infrastructure projects. The platform’s high launch frequency provides broad exposure, though project quality and performance differ across offerings.

Typically attracts:

Retail participants seeking lower entry thresholds and structured access to early-stage token sales.

Polkastarter: Multi-Chain IDO Launchpad With Governance Elements

Polkastarter operates as a multi-chain IDO launchpad, supporting projects across Ethereum, BNB Chain, and other networks. Its listing process incorporates governance features that allow community participation in project selection.

The platform is often associated with early-stage DeFi and infrastructure initiatives that aim for cross-chain deployment. As with all IDO environments, project outcomes depend heavily on execution beyond the initial sale.

Typically attracts:

Users interested in cross-chain exposure and community-driven listing processes.

BSCPad: BNB Chain IDO Platform With Tier-Based Access

BSCPad focuses primarily on projects built within the BNB Chain ecosystem. Its tier-based participation model provides varying levels of access depending on staking requirements, reducing reliance on random allocation mechanisms.

In 2026, BSCPad remains closely tied to BNB Chain activity, benefiting from lower transaction costs and a retail-heavy user base. Allocation certainty, however, is linked directly to staking levels.

Typically attracts:

BNB Chain users who prefer structured participation rules.

TrustPad: Compliance-Focused IDO Launchpad

TrustPad emphasizes operational controls such as KYC enforcement, anti-bot systems, and detailed project screening. The platform generally hosts fewer launches compared with higher-volume competitors.

Its model prioritizes process transparency and participant verification, which may appeal to users who place greater emphasis on procedural safeguards rather than deal frequency.

Typically attracts:

Participants who prioritize compliance frameworks and stricter access controls.

Enjinstarter: NFT and Metaverse-Oriented IDO Platform

Enjinstarter operates within the NFT and metaverse segment of the IDO market. The platform is frequently associated with creator-focused projects, including digital collectibles and immersive virtual experiences.

Its alignment with the Enjin ecosystem provides technical compatibility for certain projects, though performance outcomes vary widely depending on adoption and broader market sentiment.

Typically attracts:

Teams and participants focused on NFTs, digital ownership, and metaverse-related use cases.

Why IDO Launchpads Still Matter in 2026

IDO launchpads now serve as gatekeepers of early-stage crypto innovation. Beyond fundraising, they provide:

- project vetting and due diligence

- allocation frameworks that reduce bot activity

- structured vesting schedules

- early liquidity coordination

For investors, launchpads reduce exposure to unverified teams and chaotic token launches. For founders, they offer instant community access and operational credibility.

How to Choose the Best IDO Launchpad for Your Strategy

When evaluating IDO launchpads in 2026, focus on:

- historical project performance, not just hype

- niche alignment such as GameFi, DeFi, or NFTs

- chain compatibility if you want multi-chain exposure

- transparency around vesting and tokenomics

- security features like KYC and anti-bot systems

Experienced investors increasingly treat launchpads as long-term tools, not one-off opportunities.

How IDO Participants Withdraw and Realize Profits

IDO launchpads distribute tokens, not fiat. After a Token Generation Event, participants typically:

- claim unlocked tokens via their wallet

- trade them on supported DEXs or centralized exchanges

- convert proceeds into liquid assets such as USDT or ETH

- withdraw via a centralized exchange with fiat support

Understanding liquidity timing and vesting schedules is critical to managing risk.

The Future of IDO Launchpads

In 2026, IDO launchpads are evolving into full-stack Web3 platforms, offering incubation, compliance support, analytics dashboards, and multi-chain deployment. Upcoming platforms are focusing on sectors like AI, real-world assets, and tokenized infrastructure.

This shift reflects a broader move away from speculative launches toward structured, data-driven fundraising.

Final Thoughts

The best IDO launchpads in 2026 are no longer defined by hype cycles but by discipline, transparency, and execution quality. Platforms like Seedify, DAO Maker, and Polkastarter demonstrate how early-stage investing can be approached strategically rather than emotionally.

For investors, the edge comes from treating IDOs as structured opportunities, not gambles. For founders, choosing the right launchpad increasingly determines whether a project survives beyond its initial listing.

Some IDOs remain profitable, but returns are far less consistent than in earlier cycles. Most Reddit users now stress platform quality, vesting schedules, and post-launch liquidity over hype.

No IDO launchpad is risk-free. Platforms with stricter KYC, anti-bot measures, and limited launch frequency are generally viewed as lower risk, though safety depends on each individual project.

Common reasons include short vesting cliffs, early investor sell pressure, weak liquidity planning, and overvaluation at launch. Reddit users frequently cite tokenomics as the main issue, not the launchpad itself.

Most operate in regulatory grey areas. Users are responsible for compliance with local laws, and many Reddit threads warn against assuming launchpads provide investor protection.