- Bitcoin, Ethereum, and XRP prices extend losses this week, with BTC testing $107K support, ETH under $4K, and XRP’s market cap down $18B.

It has been another difficult week for cryptocurrencies. Bitcoin slipped back toward $109k, Ethereum lost the $4,000 handle, and XRP continues to search for a reliable floor. The drop has wiped billions from the market, reminding investors that this is still a fragile recovery.

Yet beneath the surface, there are some signs of quiet accumulation. Larger holders are still buying into weakness, derivatives positioning has cooled, and traders say this pullback feels more like a reset than a collapse.

Bitcoin Price Drops Toward $107K: Can Whale Buying Prevent a Bigger Crash?

Bitcoin’s rally has stalled. After a strong run earlier in the quarter, price has been stuck in a broad range and is now threatening to break lower. The latest move down took it from $117k to just above $109k, with many watching the $107k support like hawks.

On-chain data shows whales have added close to 30,000 BTC this week. That sort of accumulation usually acts as a cushion, but the timing is tricky. U.S. GDP came in stronger, lifting the dollar and pushing risk assets under pressure. With the Fed in no rush to cut rates, Bitcoin’s momentum has slowed.

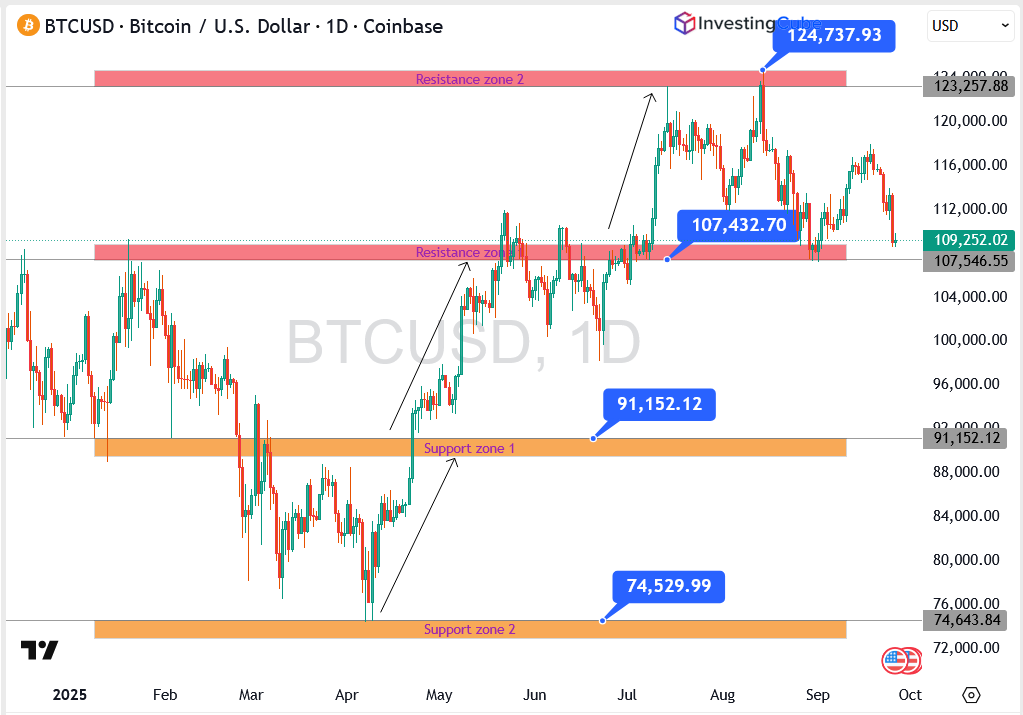

Bitcoin (BTC) Chart Analysis

- Immediate support: $107,432.70 – losing this risks a slide back to $91,152.12.

- Stronger floor: $74,529.99 – a breakdown here flips sentiment fully bearish.

- Upside resistance: $124,737.93 – bulls need a clean breakout above this to re-ignite momentum.

- Structure: Neutral-to-bearish bias unless $107K holds.

Ethereum Price Crashes Under $4K as Insider Move Sparks Panic

Ethereum has had the roughest week of the majors. Price fell below $4,000 after co-founder Jeffrey Wilcke moved 1,500 ETH, roughly $6 million, to Kraken. While that doesn’t guarantee a sale, the optics are poor. Traders remember his earlier large transfers, and with $250 million already leaving ETH products this week, confidence was shaky enough.

ETH has now dropped nearly 20% in just under two weeks. Analysts say unless bulls can quickly reclaim $4,100, the risk of a slide toward $2,700 remains in play.

Ethereum (ETH) Chart Analysis

- Key support: $4,062.43 – ETH already slipped under it; staying below adds pressure.

- Secondary support: $2,675.51 – a failure here exposes $1,410.25.

- Resistance: $4,954.60 – reclaiming this resets the bullish case.

- Structure: Short-term bearish while below $4,062, with risk toward $2,675.

XRP Loses $18 Billion in a Week: Is the $2.70 Support About to Break?

XRP’s decline has been just as punishing. Its market value has shrunk by more than $18 billion in a week, breaking below the $2.80 zone and testing $2.75 support. Traders are nervous because if that level gives way, $2.70 and then $2.01 come into focus fast.

Part of XRP’s problem is simply sentiment. It isn’t attracting the same speculative flows as Bitcoin or Ethereum, and ongoing legal uncertainty still lingers in the background. That makes it harder for rallies to stick.

XRP Chart Analysis

- Critical support: $2.7228 – holding above this keeps bulls in play.

- Deeper support: $2.0135 – losing it opens way for heavy downside.

- Resistance: $3.6468 – a breakout here would signal bullish recovery.

- Structure: Consolidation, but risk builds if $2.72 breaks.

Crypto Market Outlook: What Could Trigger a Rebound in BTC, ETH, and XRP?

This week’s declines have less to do with crypto itself and more to do with the macro backdrop. The dollar is firm, U.S. yields are high, and investors are taking fewer risks. Against that backdrop, Bitcoin, Ethereum, and XRP all feel heavy.

But it isn’t all negative. Whale buying in Bitcoin suggests deep-pocket investors still see value. Spot ETF flows could return once volatility eases. For Ethereum, a recovery above $4,100 would go a long way to restore confidence, while XRP simply needs to hold the $2.70 area to avoid further capitulation.

For now, the slump looks like a reset, not a collapse. If the major supports hold, there’s still a case for strength heading into Q4.

Crypto FAQs

It’s possible if the $4,000 level doesn’t hold. Some traders are already eyeing $2,700 as the next big test.

Yes. Wallet data shows large players added tens of thousands of BTC this week, suggesting they see value while prices are under pressure.

Usually Bitcoin leads the bounce because of its size and liquidity. But if Ethereum can get back above $4,100 quickly, it could catch momentum faster.