Tesco stock price is trading at about 430p, which is still near its record highs of 432p. This performance is a result of changes in the sector as a whole, such as a shift in consumer behaviour, rising prices, and reaction to the pricing strategies of competitors like Lidl and Aldi.

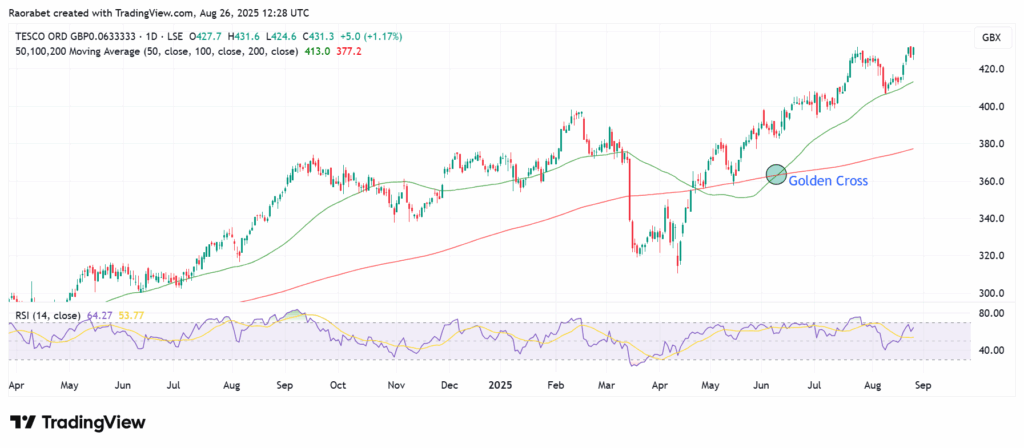

Tesco share price has had a strong display in the third quarter of the 2025 calendar year. The price went from about 402p in late June to 432p in August, which is equivalent to a rise of 7.4%.

An Overview of Tesco Financials

Tesco (LON: TSCO) has more stable free cash flow visibility than many discretionary retailers. Under the hood, the pricing movement in Q3 has followed the trend of stronger operating momentum and stable market data. Tesco’s performance update for Q1 2025/26 on June 12 said that UK like-for-like sales grew 5.1%. The company also upheld its full-year guidance, even though it described the market “intensely competitive.”

The justification for medium-term investment still depends on generating revenues, gaining market share, and exercising financial discipline. Money flow and advice. In its April preliminary guidance, Tesco estimated that its retail free cash flow for FY25/26 would be between £1.4 billion and £1.8 billion.

In addition, it estimated its underlying operating profit to come at between £2.7 billion and £3.0 billion, which is a slight drop compared to £3.1 billion in FY24/25. That range of profits takes into account more competition and more investment.

Returns and balance sheet

Despite acknowledging the tightening competition, Tesco’s management matched guidance with ongoing buybacks and a bigger dividend. That shows that they were confident in the company’s ability to make money and keep its balance sheet strong.

The competitive ecosystem: The price war is still the key issue that holds sway over most things. In the spring, the focus was on how matching discounters were putting pressure on margins. However, Tesco’s size and loyalty program have kept its share at its best level since 2016. Recent market share readings nevertheless reveal that Tesco is getting further ahead of its competitors.

What could move Tesco Share Price in Q4 2025?

The outlook for Tesco share price in Q4 2025 is cautiously positive. Analysts estimates forecast earnings per share (EPS) to grow by 6.1% each year and revenue to grow by 2.4% each year till 2027. The average price target is 430p, with highs ranging between 460 and 470p. This implies that Tesco share price could go up by 1% to 10% from the current level. This shows that people expect sales to keep going up during the holidays.

Even though we don’t yet have complete sales data for the third quarter because it is still going on, early signs point to continued growth. Group sales will likely to build on the 4.0% year-over-year gain reported for fiscal 2024/25.

- The Impact of H1 results and guidance: Tesco will announce its earnings results in October, and the figures and management comments ahead of the Christmas season will be the main motivator right away. Investors will want to know if the FY profit and cash flow ranges are still valid, and they will want guidance on how to plan promotions for Q4. Any increase in volumes or expenses would be seen as a good thing, but any focus on more aggressive price matching could lower profit expectations.

- Grocery inflation trajectory: If food prices keep going down until the end of the year, sales could stabilize as real earnings rise, but the number of promotions might stay high. However, if disinflation happens faster than predicted, it could slow down like-for-like growth, but it could also help mix and elasticity.

- The impact of competitors: The constant threat facing Tesco is that discounters will take more market share. Still, the most recent numbers suggest that the supermarket chain is gaining market share. This is primarily thanks to its wide choice of products, convenience, and Clubcard price. A strong increase in market share into the fourth quarter, especially in seasonal categories, would be a strong sign for bulls.

- Labor and cost base: There are still pressures on wages, energy, and interest rates, and management has suggested further ways to save money. Margins will be safer if there is proof of more savings than last year’s run-rate.

Tesco’s return on equity (ROE) of 13.75% shows that the company is using its shareholders’ money well. Similarly, its return on assets (ROA) of 4.36% shows that it is has put its assets to good use.

However, liquidity is a problem because the current ratio is only 0.64. That means that cash flows could get tighter in the short term. Meanwhile, the company’s total debt is £14.67 billion, which is mostly due to lease payments and expenditures linked to expansion. The debt-to-equity ratio is 125.76%, which is high.

Elsewhere, Tesco share price formed a golden cross in late June, and with the daily RSI at 64, we are likely to see an extension of the upside momentum in the near-term.

In Summary

Tesco is in a sector whose competition is tightening by the day. However, thanks to its large footprint, a lot of cash flow, and a capital-returns framework that is good for shareholders, its share price is likely to hold up. If the H1 earnings figures and guidance in October confirms stable margins and more share wins Q4 is likely to be an uptrend. However, the shares will also need to break and stay above the previous high.

On the other hand, any sign that the price war is hurting the economy faster than efficiencies can make up for it would likely bring more downward pressure until things get clearer. While financial metrics show that the corporation is heavily in debt, its market leadership and expansion strategy help ease these issues. Investors should keep an eye on the next trading updates, which are expected in October 2025, to make get a clearer picture on the medium-term outlook.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.