Rolls-Royce Holdings plc has had a tough November, with shares dipping to 1,097 pence as of the early morning trading session on November 17. That’s a notable pullback from the 52-week high of 1,196.00 pence hit in late September, marking a roughly 7.6% decline over the month amid broader market jitters. If you’re tracking this aerospace giant, you might be pondering whether this represents a timely entry point or the beginning of a more prolonged downturn.

Rolls Royce Fundamentals Signal Strength

Rolls-Royce restated its full-year 2025 expectations in a mid-November trading update. It projected an underlying operating profit between £3.1 billion and £3.2 billion, and free cash flow from £3.0 billion to £3.1 billion.

The company’s financial health is backed by big engine orders in Civil Aerospace, and strong results in the Defence and Power Systems units. For example, large engine flying hours in the first ten months of the year were 109% of 2019 levels, based on the company’s reports, which proves the civil aviation segment is strong.

Should You Buy the Rolls Royce Stock Price Dip?

So, is this dip buyable? The aerospace sector outlook remains buoyant, with ADS Group’s 2025 report forecasting sustained growth despite challenges, driven by rising air travel demand and defense spending.

Deloitte’s insights project a skills boom in data analysis for the industry, potentially aiding efficiency at firms like Rolls-Royce. UHY’s September outlook even anticipates another expansionary year in 2026, underscoring long-term tailwinds from small modular reactors and sustainable aviation tech.

The SMR business is important for long-term growth. Any material, tangible progress could re-ignite investor enthusiasm. While the long lead time for SMR profit generation is a risk, any acceleration in their development or commercialisation is a strong bullish signal.

Also, Rolls-Royce’s recent success has been built on its CEO, Tufan Erginbilgic, delivering on his transformation promises. An announcement in the upcoming full-year results that suggests the company has once again exceeded its own high-end guidance would be a powerful catalyst.

Plus, the company is almost done with its £1 billion share buyback program. If they commit to a new return program, it would show they’re confident in their future performance and make the stock more appealing to shareholders.

In this context, the November dip feels more like a breather than a breakdown. However, there are underlying risks, including the buildup of delivery inventory amidst rising supply chain constraints. Also, its forward PE is at 35-43, signaling potential overvaluation which adds pressure to outperform forecasts.

Rolls Royce Stock Price Chart

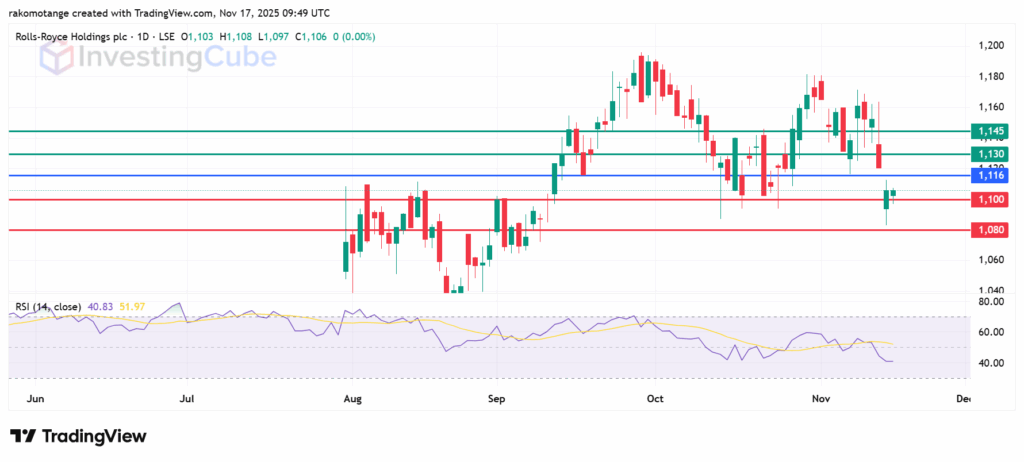

The recent price action for Rolls Royce stock has shown signs of short-term weakness. The RSi at 40 signals control by the sellers and the stock is testing support around 1,100 pence. If it goes below this, the price might fall to the next support level at 1,080 pence.

Resistance starts at 1,116p pivot, then 1,130p. Action above that level will invalidate the downside narrative and potentially test 1,145 in extension.

Rolls Royce daily chart with ke support and resistance levels on November 17. Created on TradingView

Right now, the 1,100 pence area is a key support level to watch. If the price drops below this, it might mean the stock will fall further.

New propulsion on Rolls Royce stock price could come if it makes big steps forward with their Small Modular Reactor (SMR) plans, like winning new contracts and extends its share buyback program.

Yes, reports from analysts like ADS Group for 2025 and predictions from UHY show the UK aerospace industry is set to grow. This is helped by air travel bouncing back and increased defense spending.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.