The Nasdaq 100 Index, which is heavily weighted in tech stocks, had a bit of a stumble in November, pausing what had been a pretty strong run for most of the year. While this dip might make some investors nervous, it’s important to take a closer look and figure out if it’s just a normal market correction or if there is an onset of a reversal of the upward trend.

Fed Rate Uncertainty, AI Bubble Haunts the Nasdaq

The primary fundamental factor has been growing investor unease regarding elevated tech valuations. As the index powered higher, fueled by enthusiasm for Artificial Intelligence (AI) and related infrastructure spending, some financial analysts have been pointing out that price-to-earnings ratios are too high. This worry about a possible AI bubble has led to investors selling off stocks to take profits, especially since there haven’t been many other things to get investors excited.

Monetary policy signals have added to the strain. Right now, traders think there’s less than a 50% chance that the Federal Reserve will cut rates in December. This is a sharp retreat from 90% odds a month prior, according to CME FedWatch Tool data. This shift stems from resilient economic prints, including a 0.3% October jobs gain, tempering expectations for aggressive easing.

Some good news that could help includes the government shutdown ending, which could make people want to take risks again, or softer inflation data bolstering cut hopes. Government reopening optimism already fueled a late-day Nasdaq 100 surge of 0.9% on November 14.

In summary, this slump, while uncomfortable, aligns with historical patterns where November corrections average 4-5% before year-end rallies. For patient observers, it presents a chance to reassess portfolios amid the noise.

Is A Near-Term Reversal Probable?

Even though things have been a bit weak recently, many experienced market watchers see this pullback as a good chance to buy, rather than a sign of a big downturn coming. The long-term upward trend is still in place, supported by the growing investment in AI infrastructure all over the world. Even though people are worried about stock values, many of the companies in the Nasdaq 100 are still making good money.

Nasdaq 100 Index Momentum and Levels

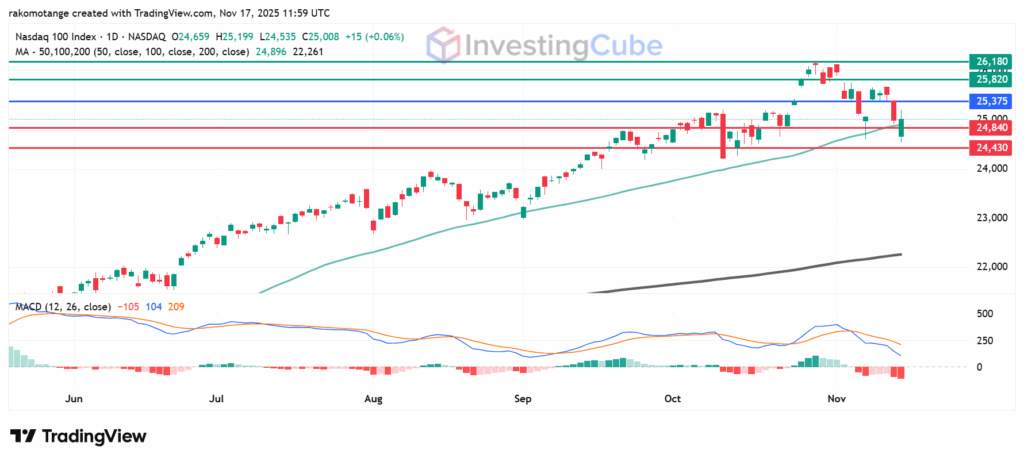

Currently, the Nasdaq 100 Index’s MACD(12,26) at -104 shows that there’s still some downward pressure. If the signal line crosses above zero, that could be a sign that things are about to turn around.

Key support level is around 24,840, just below the 200-day MA. The next support will likely be at 24,430 points. The first resistance is around 25,375 pivot, with action above that level setting it up to test 25,820. If it breaks through here, the next target is 26,180.

Nasdaq 100 Index in the pre-market on November 17, 2025. Created on TradingView

The reduced chance of a December rate cut (now below 50%) has put pressure on growth stocks, changing the previously positive outlook.

The Nasdaq’s drop was mostly due to uncertainty about a U.S. government shutdown, which made people avoid risk. Plus, there were concerns that tech stock values were too high and that the Fed was less likely to cut rates.

Even with the recent decline, people are still hopeful about the future, especially because AI tech keeps getting better.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.