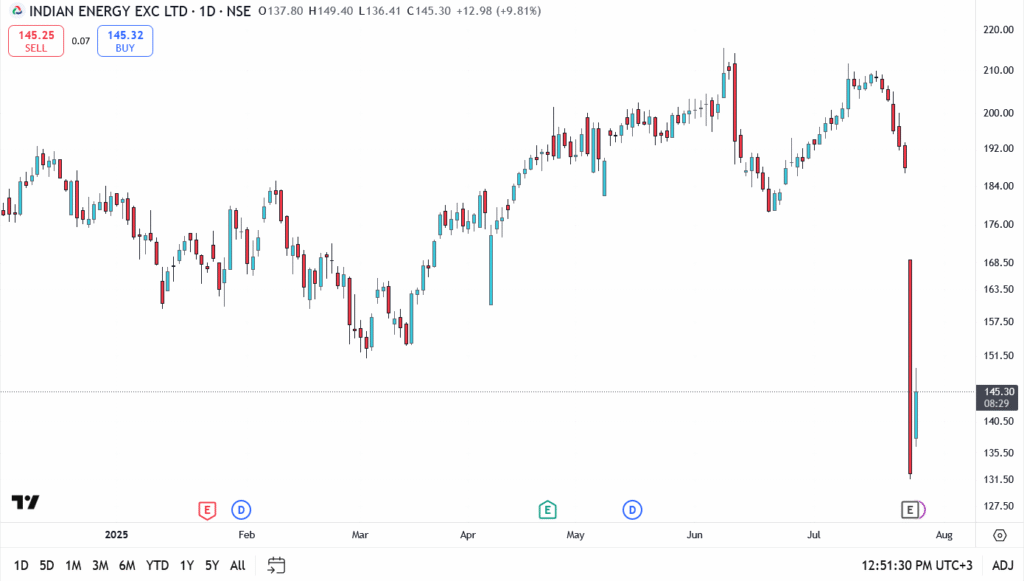

Indian Energy Exchange (NSE: IEX) shares came under heavy fire on Friday, tanking nearly 30% intraday to trade at ₹145.30. The sharp drawdown follows the Central Electricity Regulatory Commission’s (CERC) approval of market coupling, a major structural change expected to reshape how electricity prices are discovered across exchanges.

The decision threatens IEX’s core business model, which has historically capitalized on premium pricing due to its dominant market share. Traders interpreted the development as an immediate threat to revenue visibility, sending the stock spiraling to its lowest level since March.

Why IEX Share Price Crashed Today

While IEX posted a decent set of Q1 numbers earlier this week, the positive sentiment evaporated after news broke that CERC had greenlit market coupling. Under this new system, a centralized market operator will aggregate bids from all power exchanges and discover a single clearing price, essentially ending IEX’s pricing advantage.

Brokerage notes suggest this will reduce the exchange’s pricing power and could compress margins going forward. For a platform that previously commanded high volumes and attractive spreads, the shift toward a harmonized pricing mechanism has left investors scrambling to reprice the business.

IEX Share Price Technical Analysis

- Current price: ₹145.30

- Resistance: ₹157.50 and ₹165.30

- Support zones: ₹136.00, then ₹127.00

- Intraday low: ₹136.41

- Gap-down open below: ₹170

- Drop from weekly high: 30%

Outlook: What Comes Next?

The reaction from the Street suggests this isn’t just a knee-jerk selloff. The market is adjusting to a fundamentally new landscape for power exchanges, and IEX will now need to prove it can retain volumes and profitability in a regulated, coupled environment.

Technically, the chart has entered no man’s land. Unless bulls manage a close above ₹157, recovery attempts could get sold into. With sentiment shaken and no near-term catalyst in sight, the path of least resistance remains down.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.