- This guide shows you how to improve cash flow in a small business with practical, low-cost tactics you can deploy.

If you run a small business, you already know the truth most textbooks skip. Profits look great on a report, but payroll is paid with cash. Cash pays the supplier who is calling today. Cash keeps the lights on when a big client pays two weeks late. This is why learning how to improve cash flow in a Small Business is not a finance elective. It is survival.

Think about a simple scene. A design studio closes a strong month, then freezes because two invoices worth 8,000 dollars are still “processing” while rent and salaries are due in three days. The business is profitable. The bank balance disagrees. What solves that gap is not hope. It is a simple system that pulls cash in sooner, lets cash out later without burning relationships, and gives you a line of sight for the next quarter.

What Is Cash Flow and How Do You Manage It

Cash flow is the movement of money into and out of your business over a specific period. Positive cash flow means more comes in than goes out.

Negative cash flow means the opposite. The cash flow statement breaks this into three buckets. Operations covers the day to day. Investing covers purchases and sales of long term assets. Financing covers loans, equity, and repayments. Many owners also track free cash flow, which is the money left after operating costs and necessary capital spending. That leftover is what funds growth without stress.

Managing cash flow starts with a rhythm. Collect faster with cleaner terms. Control disbursements without damaging supplier trust. Keep a modest reserve in a high-yield business account. Review ratios that tell you about short-term health. Then repeat the process every week. It is simple, and it works.

A Simple Framework to Improve Cash Flow

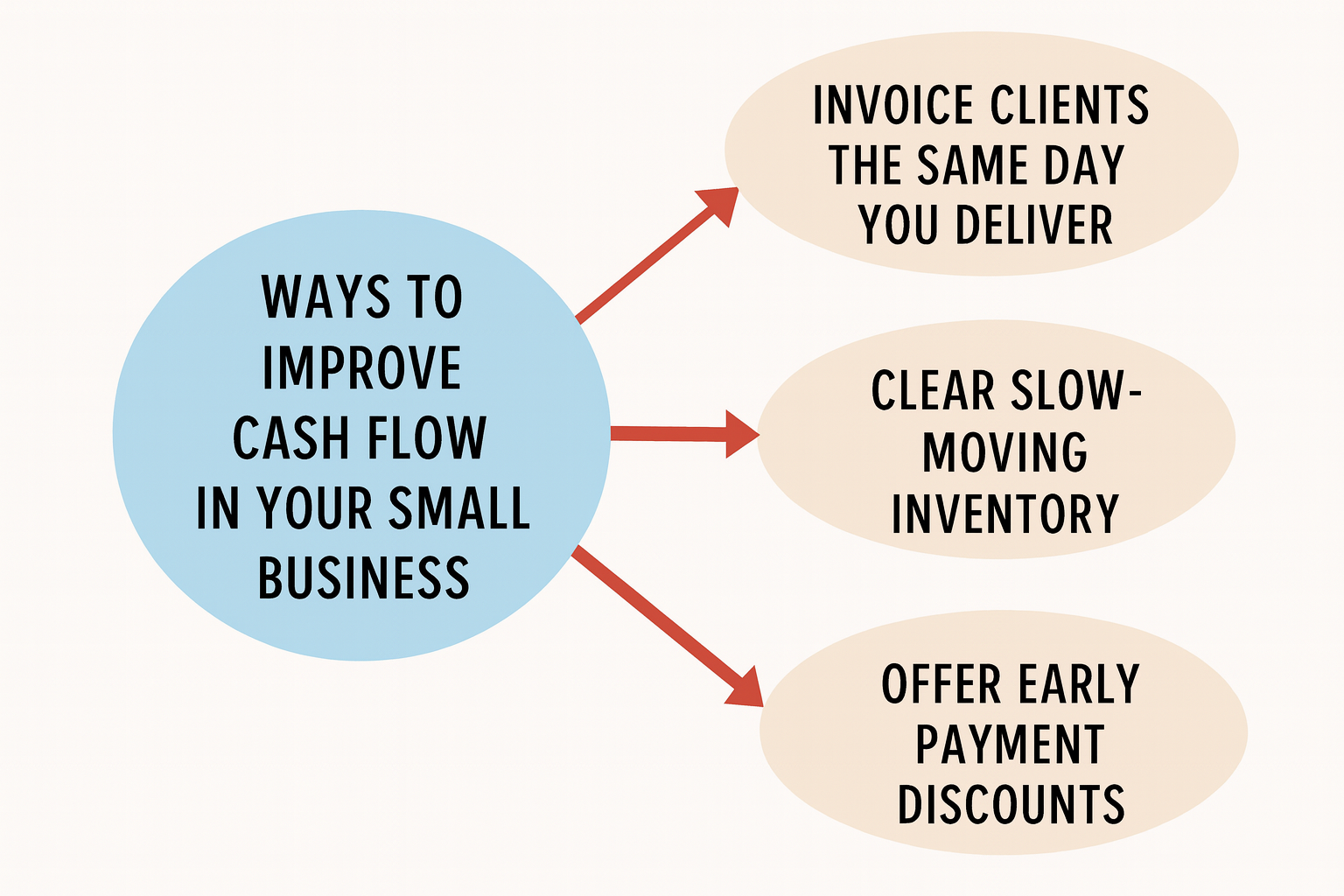

Most small-business owners don’t need complex formulas, they need rhythm and discipline. I like to keep it simple: Collect. Control. Plan.

Collect

Invoice the same day you deliver. Place the due date where clients can’t miss it and offer a small early-payment discount, like 2% if paid within 10 days. For project work, take a 40% deposit and bill the rest in milestones. For retainers, move clients to automatic monthly payments.

If a client delays, follow up early and politely. A short, direct message works better than reminders buried in accounting emails. The goal is steady cash, not endless chasing.

Control

Cash flow isn’t only about income, timing is everything. Pay suppliers on the due date, not before. If they offer 30 days, avoid giving your clients 60. Call your key vendors and negotiate better terms or early-pay discounts.

Clear old inventory; it’s money sitting on a shelf. Lease essential equipment when liquidity is tight and use credit cards only as a timing tool, clear them before interest applies.

Plan

A 13-week cash flow forecast gives you visibility. List expected receipts and expenses each week, payroll, rent, subscriptions, taxes. You’ll instantly see which weeks need action.

Track two quick ratios:

- Quick ratio – shows if you can cover bills without selling stock.

- Current ratio – measures total short-term health.

Watch the trends, not just the numbers. The aim is control, not perfection.

How to Improve Cash Flow in a Small Business without Burning Bridges

Let us tie the framework to real actions a small team can complete in a week.

- Start with collections. Choose one active client and move them to a subscription plan. Card on file. First of the month. You just traded irregular cash for predictable cash. If your work is custom, rewrite your proposals to include a deposit and two milestones. The project is the same. The timing of cash is not.

- Fix invoices next. Use one clear template. Company name. Purchase order number. What you delivered. Bank details. Due date in bold at the top. If you charge late fees, state them. Confusion slows payment more than intent.

- Review your payables on Thursday afternoon. If something is due Monday, pay Monday morning. Not Friday. If you have spare cash today, place it in a high yield business savings account. You are not trying to earn a fortune. You are getting paid for being organized.

- Call your landlord and your largest supplier. Ask for a small term improvement for the next quarter. One extra week or a small early payment discount. Most owners never ask. The ones who ask often get it.

- If growth is strong and timing is tight, consider a working capital loan. Choose the longest reasonable amortization so each payment is light. When you hit a flush month, make an extra payment. Flexibility beats the cheapest headline rate when you run a small business.

Practical Tips to Improve Cash Flow in a Small Business

Raise prices with care and data. Pick one product, test a modest increase, and watch churn and conversion for two cycles. Often the fear of changing price is bigger than the customer’s reaction.

Cut small recurring waste. Open the subscriptions list and highlight anything you have not logged into in thirty days. Cancel or consolidate by Monday. Most businesses can free up a few hundred dollars a month in twenty minutes.

Build a slow mover table every quarter. Decide if each item gets discounted, bundled, or discontinued. That decision alone unlocks more cash than most owners expect.

Create a one page dashboard. Bank balance. Receipts this week. Payables next week. Top three overdue invoices. One action for each. You will look at it more often because it is simple.

How to Improve Cash Flow FAQs

Cash flow tracks the money that actually moves through your business each period. Manage it by speeding up collections, controlling the timing of payments, keeping inventory lean, and updating a 13-week forecast every Friday.

Yes. Seasonal businesses often see negative weeks when costs arrive before receipts. The fix is planning, deposits, and a flexible line for short gaps.

No. Profit is accounting. Cash is timing. You can show profit and still struggle to pay bills if customers pay late.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.