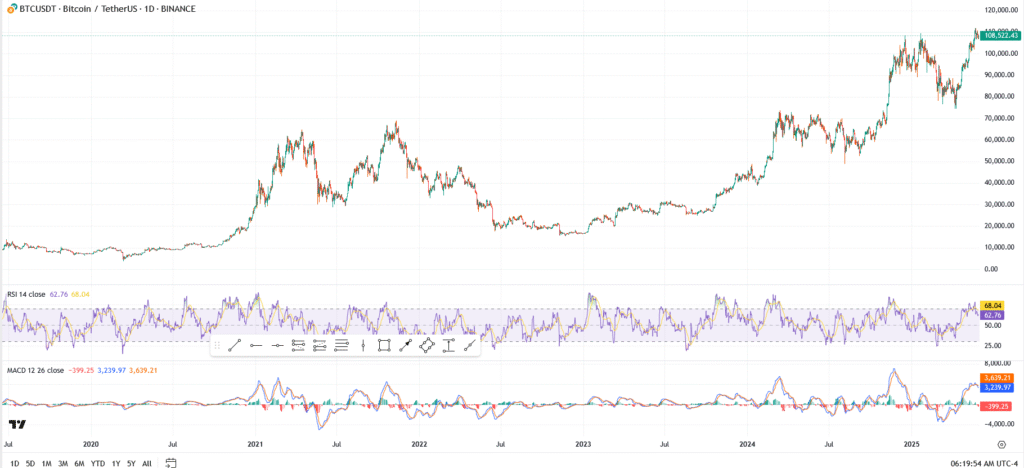

Bitcoin’s run is cooling off, not crashing, just slowing. After weeks of grinding higher, BTC is now hovering just below $110,000, and it’s starting to look a little tired. You can see it on the chart. Momentum’s still there, but it’s not charging like it was earlier this month. The price keeps nudging that $110K zone, but no real follow-through. Right now, it’s acting more like resistance than a launchpad.

Bitcoin Bulls Take a Breather as Profit-Taking Kicks In

Plenty of traders are locking in profits, and who can blame them? We’ve seen a strong move from the April lows, and on-chain data shows profit-taking is now at its highest level in three months. This isn’t panic, it’s calculated. De-risking. Booking gains. A logical pause after a vertical stretch.

The broader tone has shifted too. Buyers aren’t chasing candles anymore. There’s more hesitation, more tight stops. RSI is sitting at 68, flirting with the overbought zone — and that’s often when smart money starts scaling back.

BTC/USD Key Levels to Watch This Week

- $110,000 – still the wall. BTC keeps testing it, but can’t break through

- $106,800 – recent support zone, held firm on the last dip

- $102,400 – next major downside target if things crack

- RSI at 68 – stretched, but not extreme

- MACD is still positive, though fading, momentum is cooling

What’s Next for Bitcoin?

Probably some sideways chop. Maybe a pullback. This doesn’t look like a reversal yet, just a market catching its breath. Bulls are still in the game, but unless BTC clears $110K with conviction, the next leg might take time.

The breakout already happened. Now it’s about whether the trend can hold without the hype.