- Bitcoin price is back above $112K after weekend gains, but resistance at $125K remains a key hurdle. Traders eye ETF flows, whale moves, and dollar trends as Q4 nears.

Bitcoin’s rally has found a footing. After threatening to break below the critical $107K support late last week, a level closely watched by traders and whales, the price has since rebounded, climbing back above $112K on renewed weekend buying. The recovery signals that whale accumulation may have provided the cushion noted in Friday’s trade, but BTC still faces strong resistance overhead.

Why ETF Outflows Don’t Mean Weakness for Bitcoin Bulls

Last week’s decline was largely tied to quarter-end portfolio rebalancing. CME-based Bitcoin futures and options shed more than $4.3 billion in open interest between September 18 and 26, data from Velo show. U.S. spot Bitcoin ETFs also turned red for the first time in a month, with net outflows of around $902 million, led by Fidelity’s FBTC and BlackRock’s IBIT.

While the flows sparked concerns, market desks argue they reflect normal quarter-end positioning rather than a deterioration in sentiment. Perpetual traders, in contrast, added exposure, open interest across Bitcoin perpetual contracts rose from $42.8 billion to $43.6 billion, alongside positive funding rates.

Bitcoin Price Gets Relief From Softer U.S. Dollar and Fed Expectations

The rebound also came on the back of a slightly weaker U.S. dollar and steadier interest rate expectations, giving risk assets a short-term boost. Analysts point out that the weekend bid was not purely speculative, but tied to renewed accumulation from larger investors who had sat out last week’s volatility.

“Optimism is re-emerging,” Singapore-based QCP Capital noted, highlighting that buying pressure is broadening out as Bitcoin prepares to enter Q4, historically its strongest quarter with a median return above 50%.

Dormant Bitcoin Wallets Reactivate as Long-Term Holders Move Coins

Adding to the narrative, on-chain data show renewed activity among long-term holders. A dormant wallet holding 400 BTC ($44 million) moved funds for the first time in 12 years over the weekend, joining a series of “Satoshi-era” wallets that have reawakened in recent months. While such moves can spark short-term caution, they also underline how much value has accrued over Bitcoin’s history, up more than 830x since 2013.

Bitcoin Chart Analysis Today

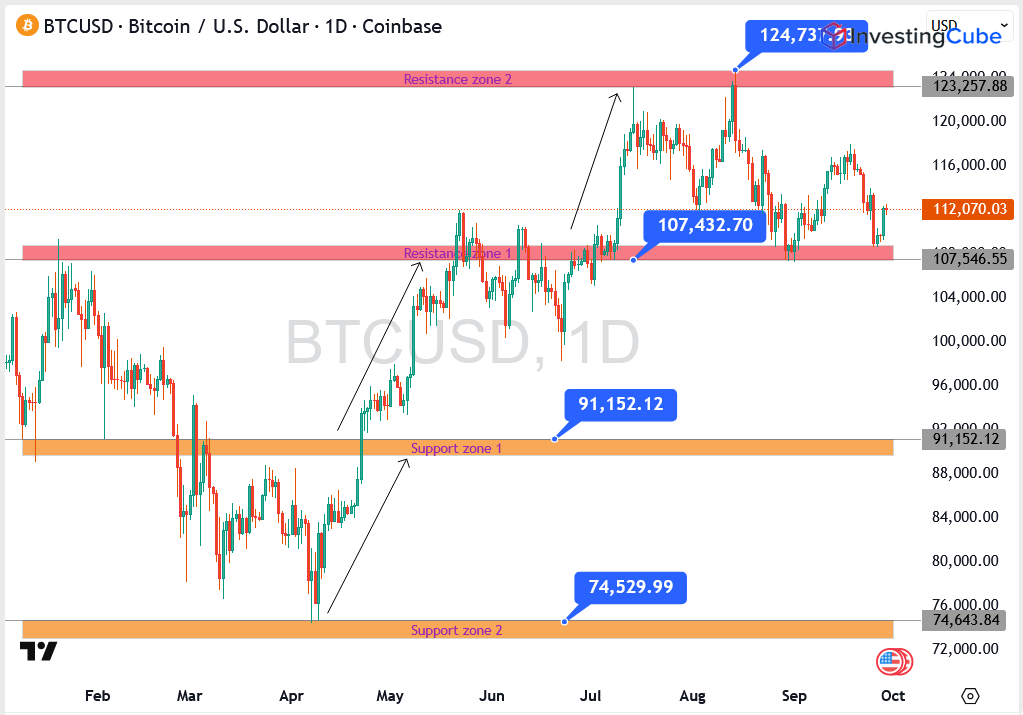

Bitcoin is trading near $112,000 after bouncing off last week’s lows. The chart shows that price is stuck in a wide range, moving between big support and resistance zones.

- Support around $107,000: This is the “floor” where buyers have been stepping in. If Bitcoin slips below this level, it risks sliding toward the next safety net near $91,000.

- Resistance at $125,000: This is the “ceiling” that has capped every rally in recent months. Unless Bitcoin breaks above it, big upside momentum will remain limited.

Right now, Bitcoin is not trending strongly up or down. Traders are watching for a clear move out of this range to set direction for Q4.

In simple terms, Bitcoin is holding steady, but the real battle is between $107K support and $125K resistance. A break on either side will likely decide the next big move.

Bitcoin Price Outlook: Key Levels to Watch Into Q4 2025

Bitcoin’s bounce back above $112K is a positive sign, but the market is not out of the woods yet. The $110K area remains the line that buyers must defend, while $118K to $120K is the zone that needs to flip for momentum to return. If price clears $125K, traders will start talking about a proper Q4 rally. For now, sentiment is cautious, ETF flows have softened and the macro picture is still cloudy, but Bitcoin has a habit of surprising when positioning looks heavy on one side.

Bitcoin FAQs

Many traders want to know what’s driving the slide: macro pressures, leverage squeezes, or profit-taking.

There’s a lot of chatter about whether large holders (whales) accumulating enough BTC can act as a floor to stop a bigger fall.

Given recent outflows and inflows, investors are curious how spot and futures ETF activity is affecting sentiment.

Many want to see how interest rate expectations, dollar strength, or macro policy moves are feeding into Bitcoin’s direction.